It is important to differentiate traders from investors. Although both profit in financial markets, the terms are not interchangeable and it is necessary to use each one in the right context. Traders and investors have distinctive perspectives when it comes to buying and selling securities. Let’s explain the difference between the two to clear up any confusion surrounding this common misunderstanding.

What is an Investor?

An investor is someone who acquires an asset with the expectation of profiting over the long run. Investors practice a buy and hold approach, and often keep the asset for months, years or decades before cashing out.

For instance, if you are an investor and buy some shares of a publicly listed company, you’re not greatly concerned about what may happen to that stock in the next few hours, days, or weeks. You care much more about its long term price movement.

Investors hope the value of their assets increases over time. Assets that appear undervalued relative to future expectations are most attractive to investors. They also plan on profiting off of any dividends they may receive from holding common or preferred stock.

Investment decisions are often guided by the work of analysts, who may base their recommendations off of financial statements, growth potential, and ratios amongst much else. Predictions on future company, sector and/or economic outcomes are key factors in this process.

What is a Trader?

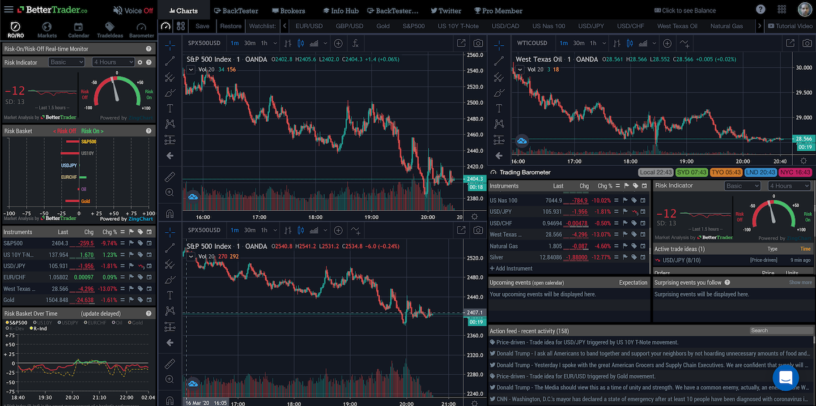

Unlike investors, traders do not care about the long term value of an asset. They want to get in and out of a trade in a matter of minutes or hours.

Traders base their movements off of predetermined analysis, which typically includes backtesting and paper trading. It is common to plan trades around an economic or company announcement.

Traders look for patterns in historical price charts as a guide of when to buy and sell a security. As investors may find it attractive to enter when prices dip undervalue, traders often look at rising prices as they hope to ride and capitalize on an asset’s short term momentum.

A trader’s profit (or loss) is not always calculated the same as an investor’s either. It is exclusively the difference between their purchase and selling prices, as equity traders do hold positions long enough to collect dividends (traders don’t).

Does a Trader or Investor Take on More Risk?

Traders take on the most risk as price movement is typically more volatile over the course of a day compared to the long run. Any unexpected news can dramatically alter short term prices and lead to a failed trade. However, with this added risk the potential for large, quick returns is greater.

Prices tend to move up and down a little every minute. When traders buy and sell a lot of shares within the hour, they can reach huge profits in a short amount of time. Although trading takes on more risk than investing, it does not take as long to develop and can lead to faster returns.