As traders, we are constantly influenced by external factors. Whether it be the news, our phones, or the actions of the other traders, it is very easy to act rashly and impulsively. But it never works out well. A week later, we look back at our emotional trade and ask ourselves, “How did I get so caught up in the moment.” Sound familiar? It’s not just you; thousands of traders are guilty of this– even the best ones.

But with new artificial intelligence and advanced computer software, you have the ability to remove this aspect of your trading and only focus on what’s numerically the best option.

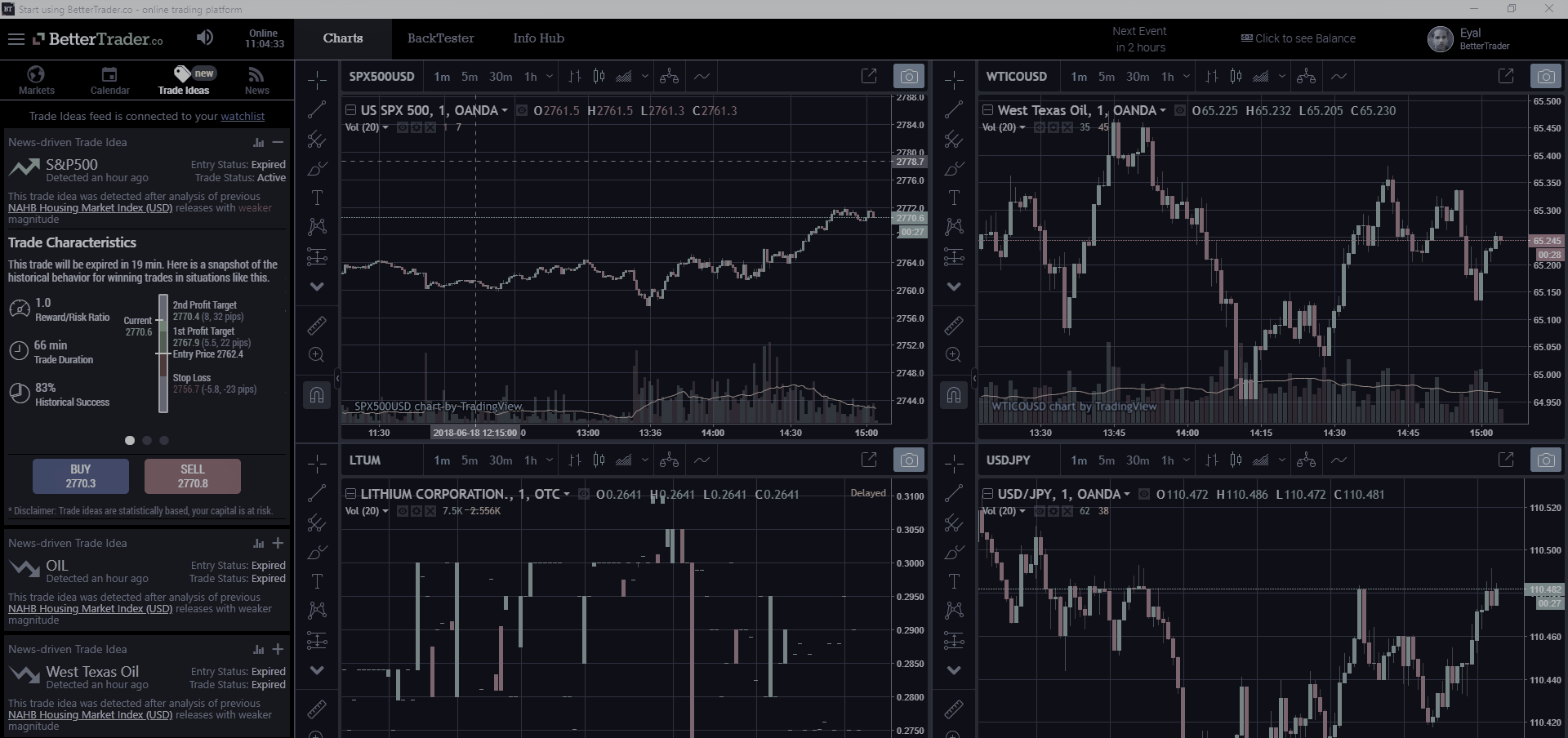

In today’s blog post, we will discuss how automated trade ideas, backed by AI or other computer software, can help you make trades solely based on price movements that are influenced by historical data. We will first define what an automated trade idea is, how it became popular, and why it is guaranteed to multiply your profits.

What is an automated trade idea?

An automated trade idea, also known as algorithmic trading, allows traders to pre-establish specific rules for both trade entries and exits; once these specifications are programmed, a trade that meets them will be automatically executed. Because it is automatically executed, it removes the possibility that you will be influenced by an external factor, such as how other traders are trading, or some news that you might feel affects the asset’s price.

Traders must have some software (trade automation software is very popular, so just Google them and find the one that best meets your needs) to automate their process. You do not need coding skills; all you need is knowledge of what you want your rules to be (however, programming knowledge is helpful to make advanced automation). This can be anything from a specific entry price point for a random stock to advanced money management rules for when to sell and buy a certain amount of shares at certain times of the day.

What are some examples of specific rules that could help my trading?

Most trading platforms have trading guides (more commonly known as “wizards”) that will help beginners understand the platform and how to enter specific rules. Usually, you can select from a list of common technical indicators to build a set of rules that will automatically execute trades. For example, a user can input the type of order (market or limit order) and when the trade triggers (at the close of the bar or the open of the next bar, for example, from Investopedia).

If you have advanced programming knowledge, you can choose to edit the actual programming code of the platform to customize your own indicators. You can also work closely with a programmer who specializes in the underlying language to help build custom rules if you don’t have a background in programming.

What are the benefits of automated trade ideas?

First and foremost, it removes emotional trading. Especially for those who get cold feet or are afraid to “pull the trigger” on large transactions, automation removes the trader’s ability to question or hesitate. Once the program finds a trade that meets the criteria, it is executed. On the flip side, automation can reduce overtrading; this occurs when a trader jumps at every available opportunity without carefully considering the ramifications. This is also a form of emotional investing, and those who are too eager can benefit from automated trade ideas.

Another advantage is that automated trading allows a trader to have multiple trading strategies in multiple accounts, so your trading method can be diversified. This will have positive effects in the long-run because diverse strategies not only help you learn more but can minimize losses in times of trouble.

Conclusion

In this blog post, we defined automated trading systems and how they can help traders make smarter, less emotional decisions. This is important because as a trader we make dozens of trades a day or week. So many trades can begin to wear down the trader and cause him to be emotional.

By setting specific rules and having a software search for trade opportunities, this emotion is removed. We also discussed an example of a specific set of rules and how they can be used to increase your profits. Remember, you don’t need all of the programming skills that some of the current day traders have; you just need to follow the software you use and learn the program slowly.

Overall, automating your trading has multiple benefits that will allow you to take your trading to the next level– you just need to know your strategy and what works for you.

Access automated trade ideas >>

Next Article: How Trade Ideas Can Help You Navigate Your Trading Day