Although backtesters are effective analysis tools, traders are the recipients of the analysis and must use it effectively to generate profits. Below we discuss several tools traders can utilize to maximize their profits and get the most out of their systems.

(1) Proper Money Management

Traders can ensure that they remain in the market for a long period of time by noting the exact amounts they can afford to lose at the end of each day, week, and month. Through proper money management, traders can gain vital experience, increasing their probability of long-term success.

(2) Strict Trading Algorithm

By implementing and diligently following a strict trading plan, traders can identify the exact strategies that led to a profit or loss. Strategies that produce a loss are sources of valuable information, as traders can learn to avoid them. Profitable strategies can be reimplemented in order to multiply profit.

(3) Detailed Trade Log

Traders must keep a running log of all trades using screen capture. Each trade must contain a detailed description of the entry price, stop loss, profit targets, trade duration, closing price, and realized profit. Experts cite introspection as an effective tool and recommend traders write about why they decided to make a trade, as well as the emotions they felt while trading.

(4) Demo Account Tests

Traders can test their trading strategies alongside analysis provided by backtesters by paper trading. Demo accounts serve as a psychological tool and allow traders to develop discipline. Traders can practice sticking to their strict trading algorithm and keeping detailed trading logs with demo accounts.

(5) Continuously Improve Trading Strategy

For profitable trading strategies to remain relevant, traders must continuously improve their strategies. In doing so, traders will construct winning trade plans for long term success.

Does Historical Performance Guarantee Future Success?

In order to get the most out of backtesting, it is vital to combine the software with your own ideas. The need for human analysis comes from the fact that past performance does not necessarily guarantee future returns. If it did, backtesters alone would be able to generate enormous profits by simply following past trends.

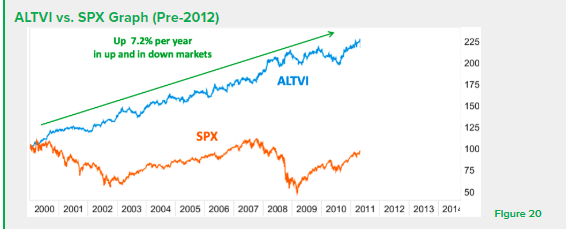

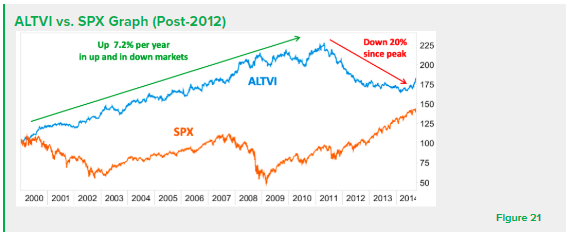

For example, ALTVI, an excess return index, was a top-selling fixed income annuity and consisted of twenty-four different futures contracts, commodities, rates, and currencies. The index generated higher returns than the S&P 500 Index (SPX) and was up about 7.2% per year since 2000 (Figure 20). After constructing an in-sample backtest, ALVTI would seem to be a profitable investment.

Although the backtest would detect that ALTVI was a profitable investment, the live data after 2012 demonstrates the unforeseen risk. Backtesting software would attempt to identify this risk by evaluating economic events and movements in leading markets, but there is no guarantee that it would detect the sudden fall. Therefore, there is always a risk associated with backtesting, as is the case with any financial trade.

Continue to the next part of our backtesting series here