Important aspects to consider when choosing between future and forex brokers:

Introduction:

Often times brokers will attempt to hide commission costs in order to attract more traders to use them. Unsuspecting traders will use them without analyzing the concept that there’s no such thing as a free broker. Ultimately when brokers claim to be free, they have a plethora of costs that are added to the bid-ask spread and traders end up paying more while thinking they are paying less.

Example:

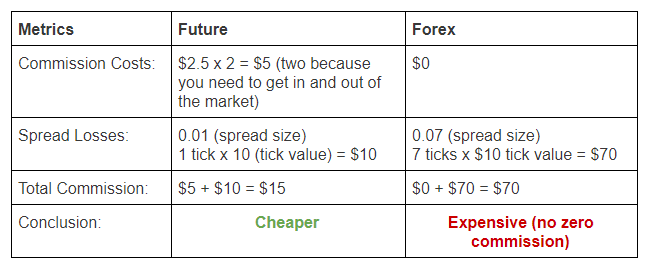

Using the same transaction let’s analyze how the commission ends up in the case of a futures commission versus the case of a forex zero commission. For this example, we will create a situation where one enters the market in opening position and then immediately exits.

→ Traded Asset: West Texas OIL

→ Trade Size: 1000 barrels

→ Tick (0.01) Value = $10

→ Current price in the futures market: Bid 60.05 – Ask 60.06 (same for all futures brokers)

→ Current price in the forex market: Bid 60.02 – Ask 60.09 (different from broker to broker)

→ Futures 1 lot commission $2.5

→ Forex broker claimed commission: 0

What ends up happening:

Conclusion:

It is clear from this chart that the seemingly zero commission forex broker ends up being significantly more expensive. Through hiding their commission through spread they are able to charge more. The future commissions, however, are upfront and as a trader, you would be able to identify and follow commissions thoroughly. It is key to recognize this and prevent yourself from getting trapped in the idea that there is such a thing as a free broker.