7 tips from pro traders: How to not blow your trading account

It is human nature to be afraid of losing our money, but in trading, losing money is sometimes unavoidable. The question is, how do we manage to lose as little as possible, or how do we avoid blowing our entire account? This article will outline a few important steps and concepts to consider in order to help you not blow your account. Through following these steps, not only will you “stay in the game”, but they will ensure that you will become a more successful trader.

Step 1: Be educated about your trades

Do research and learn about important indicators and market trends. From this knowledge, make your own informed decisions about trading, instead of following the actions of other pro traders. Listening to their advice is good, but simply following their actions is a poor strategy. There will always be a delay between their action and yours, which can lose you serious money. You will miss out on prime opportunities. Additionally, there may be alternate motives and reasons another trader is making an action that you are unaware of. Where something might benefit them, it may harm you.

Step 2: Keep your emotions in check

Emotion-based trading never works. Decisions should never be based on fear, anxiety, exaggerated perception of danger, or market hype. These types of decisions lead to impulsive actions, overtrading, or avoidance of trading.

Step 3: Set realistic goals for yourself

You are not at all likely to become rich overnight. Instead, set weekly, monthly and yearly goals that you can accomplish. Additionally, understand that there will be struggles. A lack of this understanding results in quitters. Even pro traders who do this for a living only expect to earn between 100-200% a year. Be humble and don’t expect something that is not reasonable. Ultimately, doing so means you’re taking too much risk for your own good.

Step 4: Analyze and take notes on your trades

Through writing down and analyzing your prior trades, you will be able to look back and see trends of what is working for you and what isn’t. Log your trades for these references and be sure to include statistics such as holding period, average gain size vs average loss size, long/short vs PnL%, win ratio etc.

Step 5: Talk to other successful traders

Network and gain insight and wisdom from the people in the same boat as you. This is important info not just regarding trading skills but also regarding shared emotions around trading. More than anything else, trading is 80% a mental game so learning how to keep mental health strong while trading is crucial.

Step 6: Think about loss, because it’s inevitable

Set a stop loss for yourself and take the risk factor into account. Don’t risk more than you should! Always follow the 2% rule, which states that you should not invest more than 2% of your balance into a single trade. If you risk more than that and lose it, the loss is much more significant and much more difficult to “earn back.”

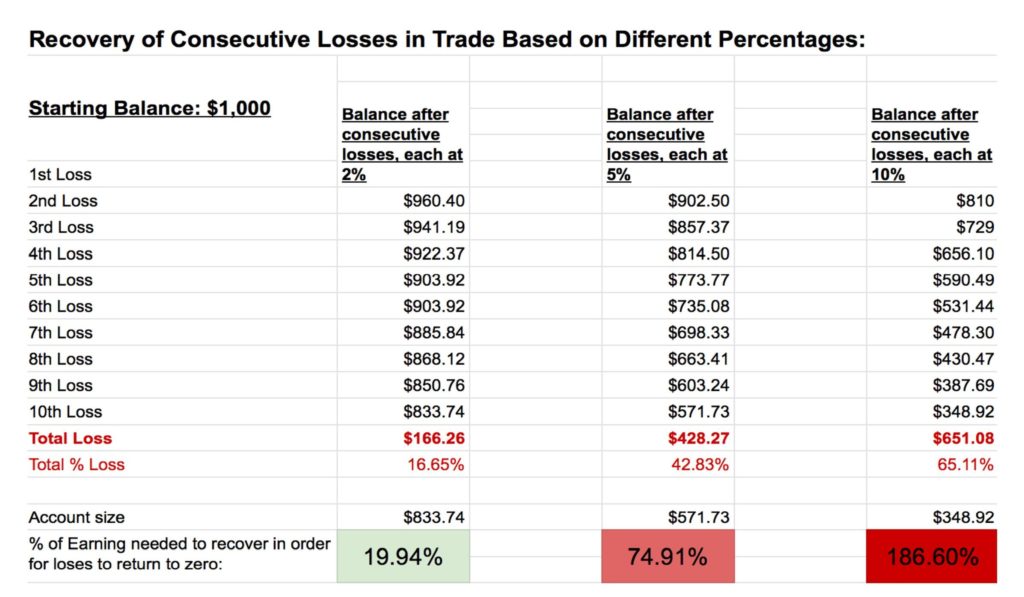

Here’s an example of the importance of the 2% rule:

This chart shows the potential danger of investing a large portion of your capital in any single trade. As you can see, the more money that is invested, the higher both the monetary loss and the percentage loss is. The losses pile up seriously over time, and it becomes harder and harder to earn back the lost capital.

Step 7: Create diversity in your toolbox

Be sure to have trades in a variety of asset classes and markets. By diversifying your trades, if one asset class or market moves in an unexpected way, the negative impact is reduced.

These simple steps can help ensure you won’t blow up your trading account. Don’t give up! Traders that stay in the game are ultimately the ones that are the most successful. Don’t let one bad movement or loss kick you out of the game by blowing your trade.