The basic guide to setting your stop-losses

For many, a stop loss is seen as an annoyance that keeps closing your trade in the negative, only for that same instrument to shoot back up to its original position. Amateur traders say, “Why not just wait for my market to get back up to my original entry point and then sell?” The real question is, what happens when the market doesn’t go back up? What if it just continues to go down and eventually wipes out your account? You’re going to keep thinking it will go back up, but it just keeps going down. This is why a stop loss is necessary. Now how does one decide where to set their stop loss?

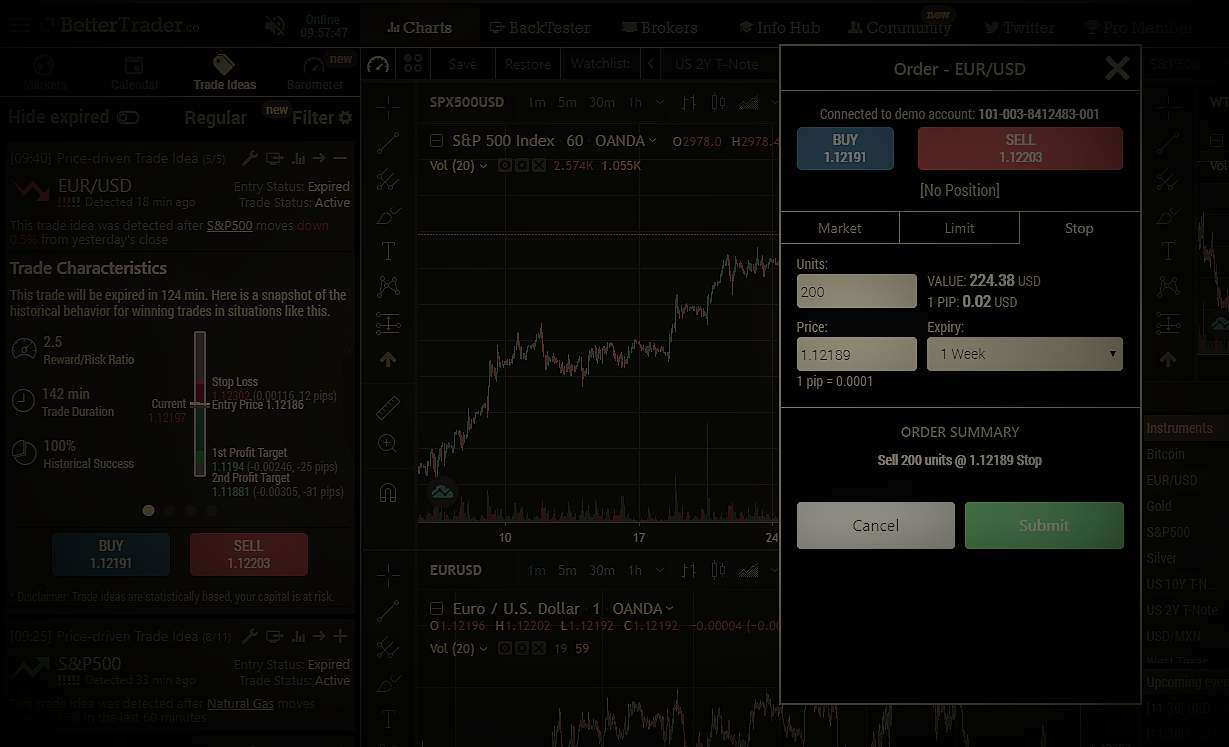

Using a stop loss

There are two critical steps that allow for one to trade with stop losses:

- Analyze market structure – This means that you need to identify the highs and lows of the market you are looking into. For day traders, you’ll want to look at a fairly recent chart like the past day or two, while a long trader might want to look into a chart that shows the past few weeks or months.

- Set the stop loss in the right place – You can’t set your stop loss too close to the lows, because it will often hit the stop loss too early. You will just lose money and eventually see your market go back up.

The top line roughly indicates the support of this chart. For stop loss, we are more concerned with the bottom line. You want to place your stop loss below that line, but not by too much. Be sure not to place it too close to the line, because that can cut your trade idea short. It’s important that you get familiar with the market you’ll be trading in, and practice setting top losses. Getting them in the right place can hugely help your trading ease and your profits.

When setting a stop loss, keep in mind two things:

- Understand how the market looks, and its structure

- Don’t set the stop loss too close to your lows on the graph.

If you can understand these two basic steps, you will gain immensely for your future day trading.