What is the Relative Strength Index?

The Relative Strength Index is a technical indicator that measures how impactful recent price changes are to the value of a security, so analysts can understand if they are experiencing overbought or oversold conditions. It was originally created by J. Welles Wilder Jr., a famous technical analyst who wrote New Concepts In Technical Trading Systems The RSI is shown on a graph between 0 and 100, and moves along this line plot according to the index.

How to Evaluate the RSI?

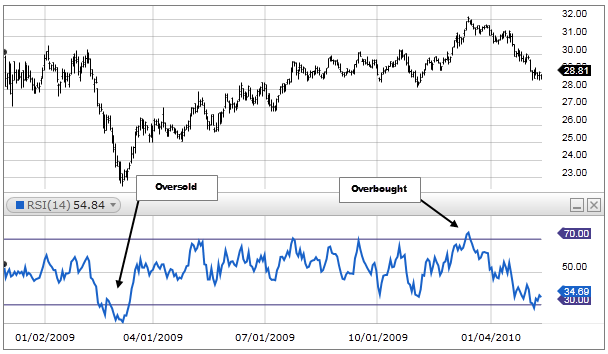

Typically, a security with an RSI over 70 is considered overbought. This indicates that the price of the security may be due for a reversal and may fall into a correction. When the RSI is under 30, this typically means that the security is undervalued and oversold.

Source: Fidelity Investments

Typically, traders will plot the RSI line along the stock price, so traders can understand what price typically leads to an oversold or overbought indicator, as shown above. Even though the RSI may be overbought (RSI over 70), the trend may continue higher. This is why it is important for traders not to rely solely on one technical indicator, and always understand the trends of the individual security, market, and economy.

Considerations to make of RSI

The RSI can never be the only indicator that one uses when analyzing securities. One must always have an idea of the long term trend of a security, and be prepared that the RSI might not conform to this movement. The trend may stay above or below the overbought or oversold mark for an extended period of time, so traders must look for other indicators to determine if it is an optimal time to buy or sell. Moreover, one using RSI could falsely predict a trend of reversal, so traders must be cognizant of all trading strategies.

Overall, the RSI is a helpful tool however in showing general overbought and oversold conditions, and should be combined with other indicators for technical trading measures.

Next Article: