Twitter has become a medium for influential people to share their opinions on markets and world events. Their opinions may cause short-term positive or negative spikes in the market. For example, a study conducted by Barron’s found that days where Donald Trump tweeted more than 35 times correlated with downtrends for the S&P 500. Following its slight falls, the market tends to recover and produce slight gains. This concept of unexpected volatility is illustrated in Figure 9. As shown in Figure 10, on days where Trump tweets more than twenty times, the S&P 500 experiences an average daily loss of 0.03%. After a ten-day period, the market recovers and experiences an average gain of roughly 0.21%. Trump’s tweets about tariffs and the United States Federal Reserve cause the market to fall exponentially higher than other subjects. Correlation should not be mistaken for causation, as there could be confounding variables that lead to the fall of the S&P 500. Kristina Hooper, a chief market strategist for Invesco, believes that Trump’s tweets are “in the same category as economic data and other daily news.” While traders should consider Trump’s tweets, Hooper does not believe that the traders should focus on the volatility that follows.

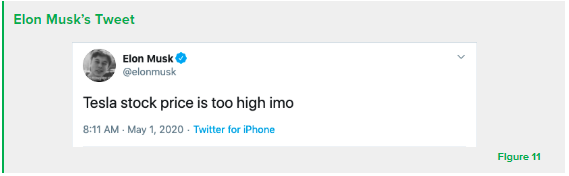

In recent news, Elon Musk tweeted that he believed the Tesla stock price was too high, as seen in Figure 11. Subsequently, Tesla’s share price fell as much as 12%. External news sources like Twitter can have an extensive impact on market conditions. Other influential Twitter sources besides Trump and Musk include Finance News, Bloomberg Markets, Holger Zschaepitz, Saxo Bank, and John J. Handy. Backtesting platforms can create a live Twitter feed so that traders may analyze tweets in real-time. BetterTrader’s Twitter Scanner gives traders voice customized notifications on nonscheduled news that can impact the markets.

Continue to the next part of our backtester series here.