Historically, backtests have been performed by institutional traders, money managers, and investment companies. These investors have high amounts of capital to construct backtesting models and develop their strategies. They backtest to, ultimately, estimate and mitigate risk. However, backtesting has become feasible for individual traders to attain.

Backtesting is a form of validation to prove to traders that their strategies have been historically effective. In turn, their confidence may rise after experiencing positive results. Even during periods of losses or economic downturn, backtesting may inspire confidence due to profits in the long-term, which makes backtesters both physical and psychological tools.

Traders will acknowledge yet endure short-term losses, as their proven, backtested strategies will render profits over time. Those who backtest have an advantage over those who completely disregard historical fluctuations or information from other avenues like economic reports.

Backtesting does a profound job of filtering out emotion while trading. Oftentimes, our opinions on market movements are driven by personal predictions and opinions. An academic journal article written by researchers of Claremont Graduate University found high amounts of dopamine involved when trading. Backtesting allows us to ground our opinions in concrete data and follow a systematic process. Subsequently, traders may accurately follow signals without an inherent personal bias to forge informed decisions.

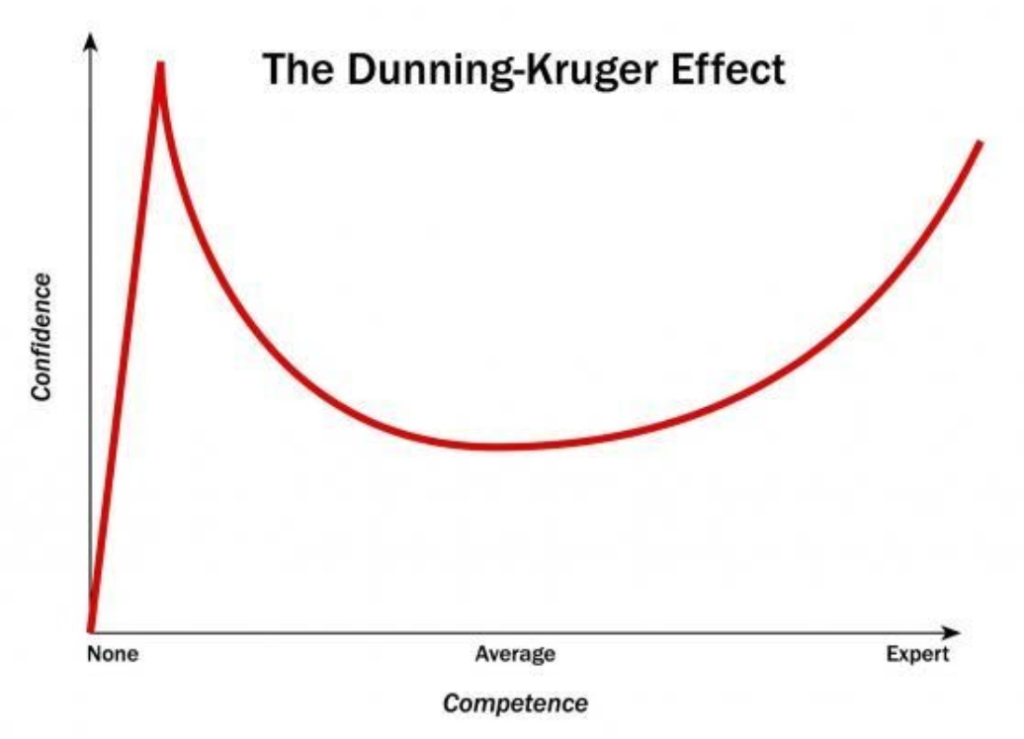

The Dunning-Kruger Effect

Although backtesting may not confirm results or profits, testing from historical data may serve as a validation tool for traders. The division between confirmation and validation is best visualized by the Dunning-Kruger Effect, which is shown in Figure 5. This effect measures a person’s competence against the confidence of their competence or ability. Those with low competence are expected to have high confidence. This seemingly paradoxical relationship was understood by researchers from Cornell University who coined the phrase “inflated self-assessments.”

A steep decline follows the peak level of confidence, which may be symbolic of a large loss in trading. However, once a person reaches an average level of competence, the person’s confidence level is positively correlated with their competence level. The Dunning-Kruger Effect applies to backtesting in the sense that those who wholeheartedly rely on backtests for their trades may experience high volatility in their results; in short, they have a low competence but high confidence in the system.

Those who validate their assessments with a backtester, as well as understand the statistics behind it, on the other hand, may reap the rewards. Ultimately, they may earn the status of an “expert” trader.

Continue to the next part of our backtesting series: here.