If you’ve read trading blogs or books, or you’ve looked around a trading platform, these are three terms you’ve heard. However, you might not know exactly what they mean, or how they’re used. New traders should familiarize themselves with these three terms, because they are essential tools for successful trading. Traders with all levels of experience and in all markets use these tools.

Entry Point

When someone refers to an entry point, they are talking about the price at which an instrument or asset was bought or sold, starting a trade. The price of an entry point, or the price at which a trade begins, is determined based on a trader’s strategy. Without a trade strategy, traders may chose entry points based on emotion or market hype, which can lead to losses.

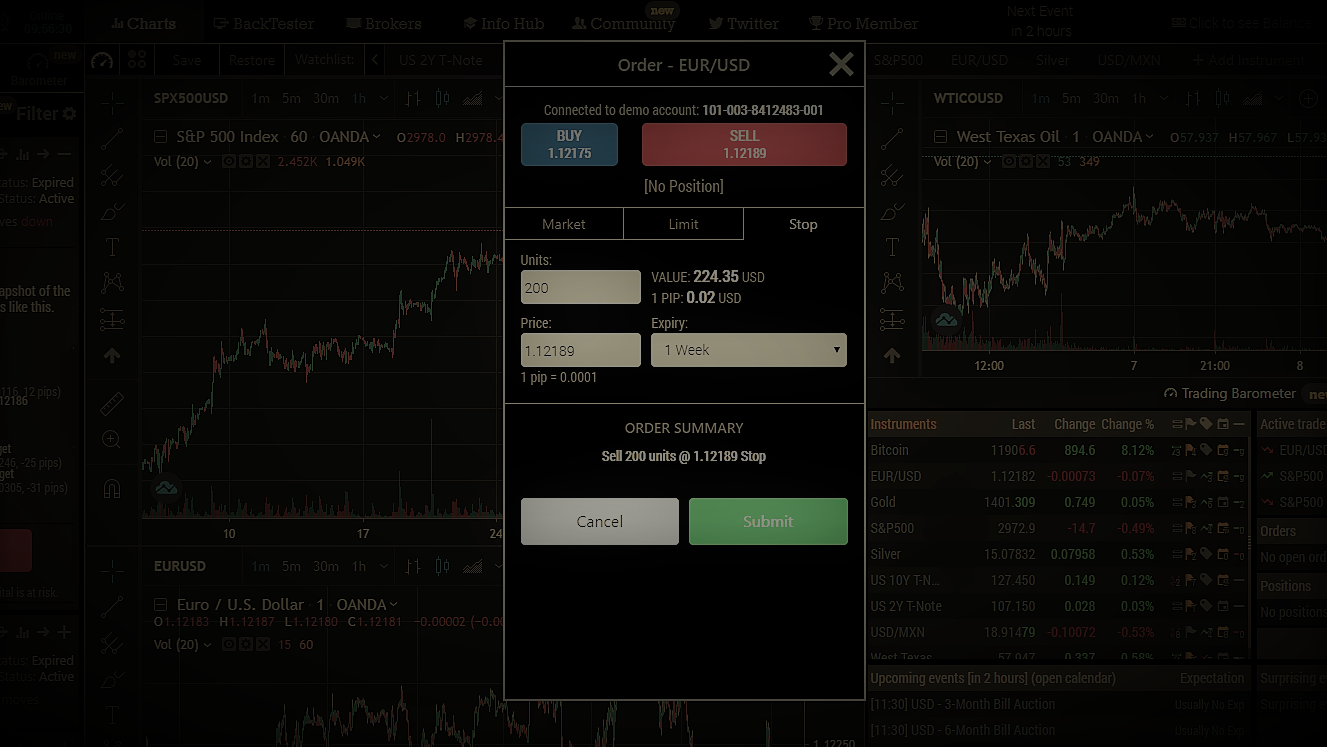

Stop Loss

At its simplest, a stop loss is the price point at which you recognize a trade is not going well for you, and get out of the trade to cut your losses. This means that it is able to reduce your losses, in the case that an asset you have purchased goes down in value.

Stop losses often are used in the form of stop-loss orders to brokers. Let’s say you have bought one share of a certain stock for $100. You place a stop loss order with your broker to sell that share when the price of the stock goes down by 15%, or reaches a price of $85. Once the price hits $85, the share will be sold at market price, which has capped your losses at 15%.

The example of one share of a stock bought for $100 seems fairly trivial. However, small amounts add up over time, and most people invest far more than $100 at a time. If you had invested a large portion of your portfolio in that stock, and it tanked, a stop loss order would stop you from losing a great deal of money.

Another benefit of stop-loss orders is the ease of trading they create. After enacting a stop-loss order, traders typically don’t have to monitor the fluctuations of the asset as closely as they otherwise would. They know their potential loss is capped, so they don’t have to focus on following the market. This leaves them free to follow other markets and look for other good trades. Also, stop-loss orders reduce the chance of someone getting emotionally attached to an asset, which can lead to huge losses.

Stop-loss orders have lots of benefits to traders, and they normally don’t have any additional fees. You only pay the typical commission you pay whenever you sell an asset. This means that traders have no excuse not to have stop-loss orders!

Profit Target

A profit target is kind of the opposite of a stop loss. Simply put, a profit target is the point at which a trader recognizes they’ve done well with a trade, and they sell to realize the profit. Traders set a profit target when they enter a trade at a specific price of the asset they are buying, and will sell the asset when it reaches that target.

Profit targets are used to mitigate risk of individual trades. This is because they can be used to calculate a risk-reward ratio. Other times, a predetermined risk-reward ratio will be use to calculate a profit target. A risk reward ratio is a measure of how much your potential reward is based on each dollar that you risk. In practical terms, the formula for calculating a risk-reward ratio is:

Risk-reward ratio = (profit target – entry price) / (entry price – stop loss)

A good way for new traders to set a profit target is to use a fixed risk-reward ratio. A typical risk-reward ratio for a day trader is between 1.1:1 and 3:1.

Let’s say a trader decides to use a fixed risk-reward ratio of 2:1. They buy a share of a stock for $100, and set the stop-loss at $85, because they want to cap their possible losses at 15%. (Normally, more sophisticated methods will be used to set a stop loss, but this will be discussed in the next article.) Next, they use the risk-reward ratio formula to calculate that their profit target should be $130.

There is no one optimal risk-reward ratio; the right ratio for you depends on your strategy. If you plan on using a fixed risk-reward ratio to determine your profit target, it’s important to backtest your strategy. The ratio you choose should correspond to your success rate. If you have a very high success rate, you don’t need to risk as much on each individual trade. Make a free demo account to test your strategy and make sure your risk-reward ratio and success rate work well for you.

Some traders choose to set a profit target and then calculate the risk-reward ratio, instead of the other way around. This can be a valid strategy, as it can be more flexible to the immediate actions of a market. However, it can also be risky. If you place the profit target too high, you will not win any trades. If you place the profit target too low, it may not compensate you enough for the risk you are taking.

Summary

The vocab explained in this article all represent very important techniques in trading. This is a good introduction, but it is by no means all there is to know. Sources like the BetterTrader Information Hub and Investopedia are great for more learning. There are lots of tools

The key is to implement all of the different techniques described above together in order to become the best trader that you can be. There are many tools out there that can help familiarize yourself with the new topics and ideas that will be essential for your time as a trader. Platforms such as the BetterTrader Information Hub, Investopedia, and many others are excellent education mediums for beginner traders.