The Elliott Wave Theory was crafted in the 1930s by Ralph Nelson Elliott. The theory asserts that although the stock markets tend to often act in a random and pragmatic nature, there are predictable market trends that must be assessed for the enterprising investor.

Elliott wave theory asserts that human psychology can be used to gauge the stock market, where movements in the market are correlated to psychological fluctuations. Essentially, swings in psychological conditions are related to waves of movements in the financial markets.

Supported by Fractal Patterns:

Elliott wave theory differs from the Dow theory in that the Elliott theory breaks markets down into fractal patterns. Fractals are mathematical structures which infinitely repeat themselves on a micro-scale. These repetitive fractals can also be observed in market index patterns, and these patterns can be used as predictive indicators of future stock market moves.

Predicting Movements with Elliott Wave Theory:

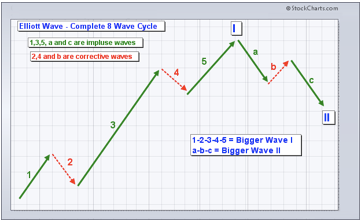

There are many stock market predictions that can be made base don the interpretations of wave patterns. The basic movements of the theory consist of impulse waves and corrective waves. Impulse waves consist of five sub-waves and travel in the same direction as the larger overall trend. Oppositely, a corrective wave moves in the reverse direction of the main trend. It also consists of five smaller waves that make up the overall wave pattern.

Understanding the trends:

In the financial markets, trends can continue to rise in an upward pattern or be corrective. Trends that occur within the financial markets are examined below:

The 5-3 move is a common market movement that exhibits the Elliott Wave Theory. In this 5-3 trend, 5 waves follow the direction of the main trend, followed by 3 corrective moves.

Image sourced from forextradingstrategies4u

In this trend, waves 1, 2, 3, a, and c form the impulsive waves that follow the upward trend. They are then proceeded by corrective trends 2, 4, and b. Waves 2, 4, and b counteract the impulsive waves. They exhibit the idea of trends and countertrends.

The Types of Waves:

In the Elliott Wave Theory, there are nine types of waves of varying degrees. They consist of, from smallest to largest:

- Grand Supercycle

- Supercycle

- Cycle

- Primary

- Intermediate

- Minor

- Minute

- Minuette

- Sub-Minuette

Considerations to Make When Using Elliott Wave Theory:

There is a clear difference between correlation and causation. Market movements can be correlated to psychological factors, however, there is not a direct link between the two. Just because movements can be indicative of future security prices does not mean that traders should believe they can predict these prices to a science. Traders using this theory should always remain up-to-date in the current market and world news, as well as developments within the security that they are following.

Next Article: