What is Intraday Trading?

Intraday trading refers to buying and selling stocks and ETFs on the same day during regular business hours. Intraday also signifies the stocks price movements. For example, to reference a new high relative to other prices during a trading session one might say “a new intraday high”. By contrast, “a new intraday low” would be in reference to the lowest price a security was traded on a given day.

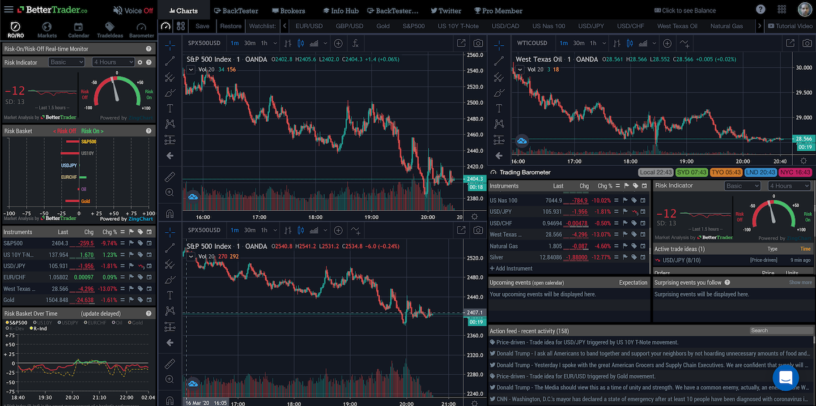

While day trading can occur in any marketplace, it is most common in the foreign exchange and stock market. Day Traders base their trades on strategies such as swing trading, arbitrage candlestick patterns and trend lines. As a day trader, you must choose entry and exit points carefully. Additionally, stop-loss orders should be put in place to limit potential loss. Day traders attempt to profit off of small, short term movements, and therefore it is hard to profit from large sums without investing large amounts or using leverage.

What Strategies Should Intraday Traders Use?

Traders must be mindful and pay close attention to price movements in an attempt to profit off of short-term price fluctuations. This strategy is known as scalping and the goal is to make many small profits on small price changes throughout the day.

Another common strategy is known as range trading which occurs when a security trades between consistently high and low prices for a certain amount of time. To determine to buy and sell decisions, range traders use resistance and support levels which represent the top and bottom of the range. When the stock hits the resistant price, the security is sold, and when it hits the support price the security is purchased.

The third strategy intraday traders use is news-based. With this strategy, traders try to profit off of scheduled news announcements which create volatility. However, due to the fact that news fades quickly after being made public, traders usually don’t hold onto positions for a long time.

11 Tips for Intraday Trading:

1 – Have a Strategy and Determine Positions

Plan a trading strategy and stick to it. Every time traders initiate a trade, it is important for them to have a clear plan of how to do intraday trading. Determining both the target, entry and exit positions before placing the buy order is crucial. It is common for a person to sell the shares even if the price sees a nominal increase. Due to this, one can lose the opportunity to take advantage of higher gains because of the price increase.

2 – Research Thoroughly

Traders are expected to research their “wish-list” in depth and be aware of all the upcoming corporate events as well as their technical levels.

3 – Invest in Two or Three Liquid Shares

It is recommended to trade in large-cap highly liquid shares since intraday trading involves squaring open positions before the end of the trading session. Investing in mid-size or small-caps can result in having to hold shares because of low trading volumes.

4 – Utilizing Stop-Loss for Lower Impact

One of the most important intraday trading tips is to use the stop-loss trigger which automatically prompts the sale of shares if the price falls below a specified limit. This is helpful in minimizing the potential loss a trader may face due to the fall in stock prices. Moreover, once the stock achieves the target price, users are advised to close their position, and not be greedy and expect higher profits. This intraday trading strategy ensures emotions are eliminated from your decision.

5 – Book Your Profits When You Reach Your Target

Many traders suffer from fear and or greed. It’s important for traders to not only cut their losses, but also to book their profits once the target price is reached because of the high volatility of the stock markets.

6 – Be a Trader, not an Investor

It’s common for day traders to take delivery of shares, which they can hold as long as they like, in case the target price is not met. Investors tend to wait for the price to recover to earn back their money. This is not recommended because as a trader you don’t care about the bigger story, you don’t like to have your position overnight, but rather want to get in and out on the same day.

7 – Move with the Market not Against

It is very difficult if not impossible for even professionals to predict market trends and movement. There are times where all technical factors point to a bull market and a decline may still occur. Factors can only be used to indicate and predict, but are by no means guarantees. Therefore, it is important that if the market moves inversely from your expectations, exit your positions to avoid huge losses.

8 – Exit Position When Market Conditions are Unfavorable

For trades that provide profits and price-give reversal, it’s advisable to book the profits and exit open positions. In addition, if the conditions are not favourable to the position, it is recommended to immediately exit and not wait for the stop-loss trigger to be activated. This will help traders reduce their losses.

9 – Start with Small Amounts

It’s very common for beginners to get carried away once they make a profit during day trading. The market is extremely volatile and anticipating trends is challenging for even the greatest professionals. For this reason it’s prudent to invest in smaller amounts that the user can afford to lose without falling into financial difficulties in case the markets do not favor them.

10 – Close All Open Positions Daily

Some traders may get tempted to take delivery of their positions in case their targets are not achieved. This is one of the biggest errors. It is crucial to close all open positions even if traders have to book a loss because you should not be betting on what will occur overnight. Such practice belongs in Las Vegas not Wall street. Every day should begin a new and clean slate without hopes or biases towards the market’s movements.

11 – Monitor Market Movements Closely

Intraday trading is not for professionals who have full time jobs, as traders must be able to monitor the market movements from the opening bell until closing to enable them to make the proper decisions as they come up.

Conclusion

In conclusion, to be as successful as possible in intraday trading be sure to follow a predetermined plan that consists of both entry and exit positions as well as target positions. Once a strategy is set in motion and thorough research has been conducted, trade in two-three highly liquid markets. This allows traders to exit open positions before the end of the trading sessions.

Next be sure to utilize stop loss triggers to minimize potential losses. Avoid fear and greed by cutting losses and booking profits as they’re reached. Do not try and time the market, and be sure to move with the market as no predictive factors are guaranteed.

It is important traders adjust expectations and exit positions if the market is unfavorable to a traders position. Lastly, be sure to have the proper time to devote to monitoring and researching the markets movements to ensure success.