What are the best strategies for profiting in trading, especially in a difficult field as FX? Here, we explore some issues with day trading, emotional investing, and market fluctuations. This blog discusses a few key steps to consistently make profitable trades in Forex. Not only does this include advanced technical analysis models, but it also deals out investing advice held by the top investors of the modern era.

Technical analysis is the pinnacle of FX investment strategies. It allows us to recognize long-term patterns which allows investors to have the strongest outcomes in their dealings. Nothing in the market is perfect, and the market can be unpredictable; however, taking a long-term approach to investing while applying analysis methods such as the “governing pattern”, the “descending wedge,” the “head and shoulders,” and the “double bottom.” By closely following the price of stocks and forex currency pairs as well as understanding how one movement may affect another, any investor can profit. We will also explore the reasons why not to get in and out of positions numerous times a day, and how to measure risk/reward.

How often should you make trades?

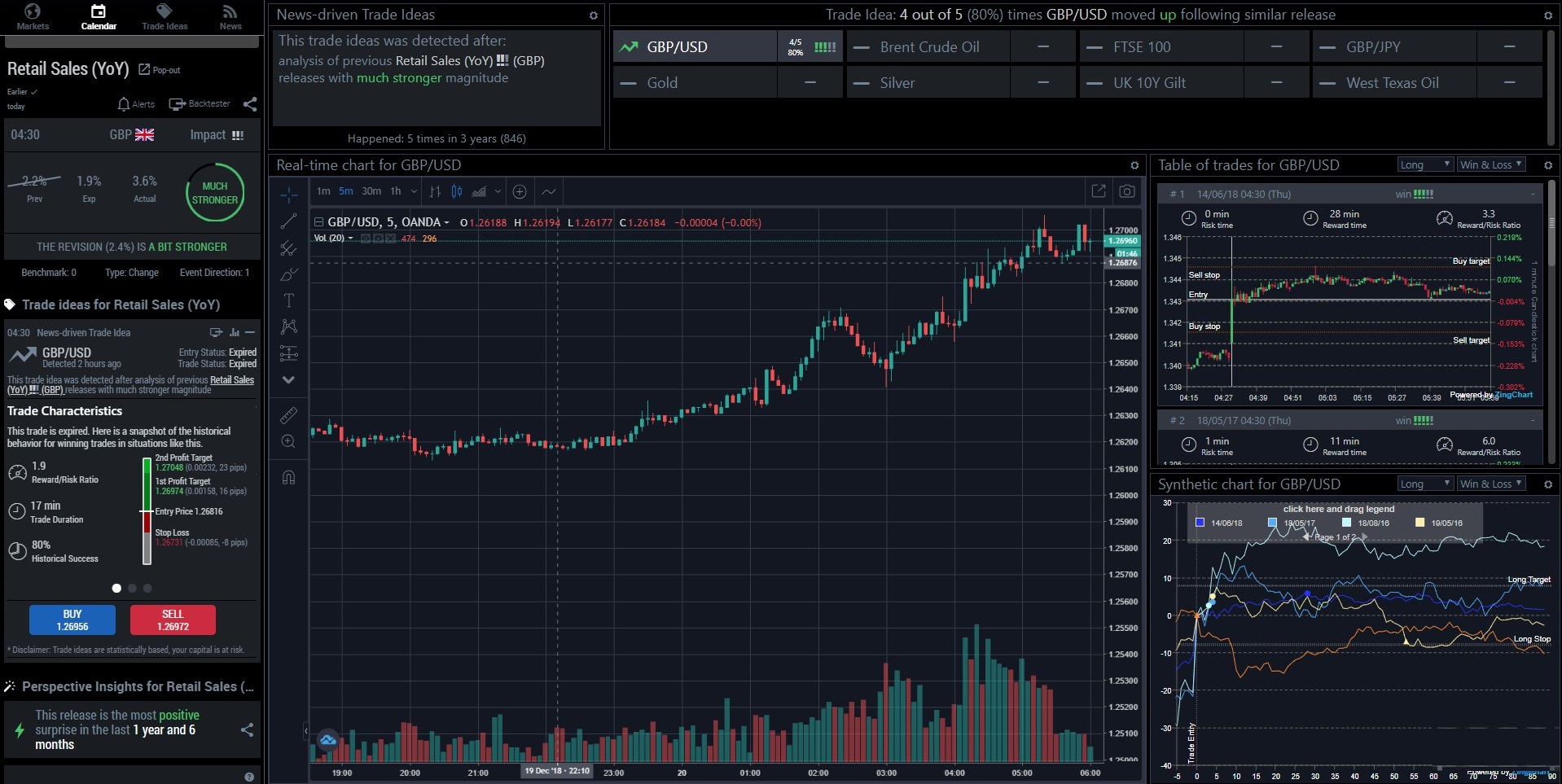

The answer is simple: rarely. The reason 90% of forex investors lose their money within 3 months is because they take the short-term, day trading method. They sit at their computer and play the fluctuations, trading a change in 10 cents here, 35 cents there, etc. The issue with this strategy is that it is not sustainable. What most investors don’t realize is that the risk/reward ratio is skewed. The winnings are too small to make significant financial gains. Also, investors usually pay high brokerage fees and the tiny pip spread that they trade adds up over time; this decreases the value of an investment.

In FX trading, this is essential advice: less is more. In fact, some investors claim that once they notice patterns based on technical analysis and mathematical models, they make a trade and then sit on it for several months– or years.

For example, let’s analyze an investment in Quantumspace (a company that deals with lithium batteries for electric vehicles), which went public last December. It sold initially at $120/share, but closed at $60. After a couple weeks, the “triangle” method and “double bottom” (technical analysis methods) indicated that this stock will continue to drop. Imagine if you shorted the stock with the quantitative evidence to suggest that the stock would continue to drop to $30. Even though it fluctuated for many months (sometimes rising above $70), it eventually broke $30. You could have made hundreds of thousands on this trade. The moral of the story? Trust the data and technical analysis and do not become emotionally invested.

Conclusion

If there’s one takeaway from this post, it’s this: do the math and analysis. Then sit back and trust your trades. Don’t emotionally invest, and don’t get caught up in the minor daily fluctuations. Also, taking the right risk/reward ratio is essential. For example, while most investments aren’t perfect (none are), look for a 3:1 reward/risk ratio. This means that if you’re looking to take a 50 pip risk in an FX trade, you must see an outcome of at least 150 pips. Most people try to extract too little of an outcome and neglect their brokerage fees (e.g. risk 15 pips to get 10 pips, but don’t realize that the broker takes 2-3 pips). This is for each trade, and these numbers add up. So the golden rule? Make worthwhile investments rely on technical analysis, and trade infrequently.