Almost all investors have the same idea when starting to trade– they read an article or see a chart of a stock, get a position on it (whether that be short, long, or a swing) and then construct an exit strategy. However, the common pitfall is that they never stick to their exit strategy. As a result, market opportunities are not maximized and traders lose potential profit. In this blog post, we’ll discuss how a successful investor knows how and when to short, go long, or play a swing position on a stock, and how to stick to the exit strategy to maximize profit.

First, we will discuss some basic technical terminology for intraday traders. We will compare day trading with swing trading ahd go over basic technical instruments that have helped countless investors form strategies in both the short and long term, such as low floats, high floats, VWAP, swing positions, and more. Finally, we’ll discuss the risk associated with intraday trading as well as long-term swing investing.

What is a “float” and a “swing” in trading?

In simple terms, a float is the amount of outstanding shares available to the public for trading. Thus, a low float means few shares are available while a high float means many shares are available. But why is this important? Well, the float shares allow investors to figure out how many shares are restricted; as a result, investors know the ownership structure and thus how much volume control the investors have.

Swing trading is a short-term to medium-term investment strategy which aims to capture a chunk of a stock’s potential price movement in a short period of time based on technical analysis factors. Swing trades are usually a few weeks long maximum, but they can also be a couple days. Swing traders usually profit using a risk/reward ratio based on a stop loss and profit target. These types of investors also look to enter a position in the short-term only if they are confident that the likelihood of the price movement materializing is in their favor. One way a swing investor will make a decision on a stock is by following and analyzing a basket of same-sector stocks for multiple days and seeing if there are similar trends across the industry.. Some of the more common patterns involve moving average crossovers, cup-and-handle patterns, head and shoulders patterns, flags, and triangles.

What is the VWAP strategy and how can it help me maximize profits?

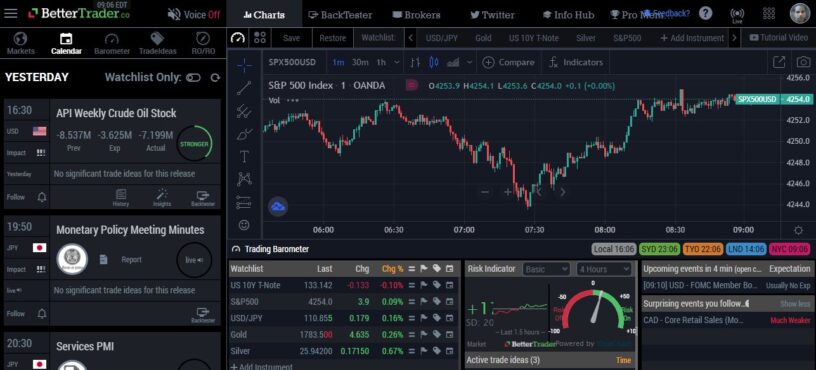

In short, VWAP stands for “Volume Weighted Average Price.” It uses both the volume and the price of a stock over multiple days to create a benchmark price for the security. The two main values that this allows a trader to gather is the value and the trend of a certain stock. Institutional buyers will often measure the VWAP to help them move into and out of stocks with a small market impact. The goal is to buy a stock below this metric and sell it above. However, a downside of relying on VWAP for all investment decisions is that it does not factor in external influences, such as economic news, political escalations, or wide sector movements. As a result, a stock can move far away from its VWAP in a short period of time. You can analyze a VWAP to determine whether an investment warrants an active or passive approach (i.e., whether the intraday trading will require constant attention or little attention).

Conclusion

Successful day traders don’t just stick to one strategy, they diversify. A wise investor uses the VWAP as well as other technical indicators (such as the candlestick, triangle, cup and handle, head and shoulder, etc.) to understand how to get in and out of a position. Also, the time one is in a position is the biggest influence on how much price is maximized. Sometimes a short position will extract the most value out of a stock; at times, a long swing position will do the same.

It is important as a daytrader to rely on these indicators and have a clear exit strategy based on them. Know when a sector is heating up and how that will influence how you maximize your profits; but more importantly, know when to get out and not get too greedy. Only a healthy balance of this will be able to increase your profits and make you a more successful day trader.