Becoming a profitable trader is all about strategy. If you keep losing and don’t know how to reach success in the market, take a step back and reassess your actions.

If you aren’t doing so already, make sure that you test every trade idea, follow an appropriate risk/reward ratio, and trust your exit points to prevent future losses. Failing traders tend to overlook one or more of these essential rules.

Test Every Trade Idea

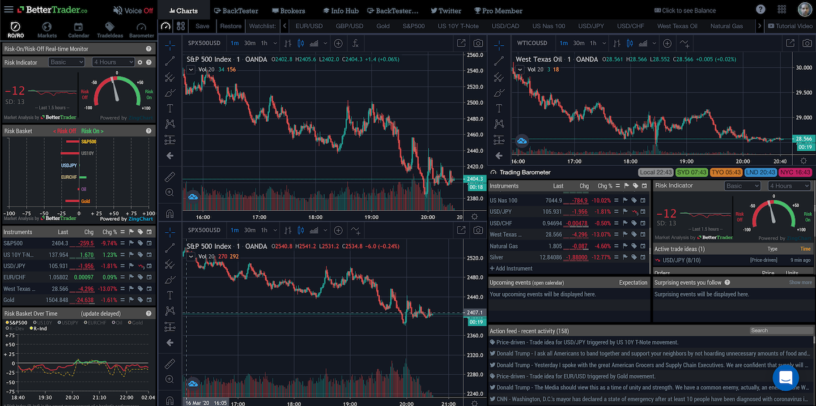

Before committing to any trade, you must test it using technical analysis to see if it’s worthwhile.

Backtest the trade idea to see how successful it would have been historically under similar market conditions. Then, you can paper trade it to simulate how it would play out in the present.

If you are comfortable in a trade’s success rate after these steps, go ahead and implement it.

Make sure you are performing extensive technical analysis on every idea if you want to turn profits. Not testing your trades is the easiest way to keep losing money.

Set an Appropriate Risk/reward Ratio

Impose a strategic risk/reward ratio to ensure that your trade has more upside than downside. This gives you the ability to fail on a majority of your trades and still be profitable.

For example, let’s say you risk $500 a trade and set your profit target at $1500 above the entry price. Even if you lose 7 out of your next 10 trades, you will net $1000 by using a 1:3 ratio.

Ensure that your trade ideas are always well tested with a 1:3 ratio or lower to maximize profits and minimize losses. Failing to do so can limit your potential profits and chances of being a successful trader.

Trust Your Exit Points

DO NOT adjust your exit points in the middle of any trade except in the event of truly, unexpected market news.

Traders sometimes tighten their stop loss once the trade turns profitable or sell early if the price starts going down. These options might be tempting in the moment, especially if you are an anxious trader.

However, you did the research and analysis beforehand to set strategic exit points. Interfering before a stop loss or profit target can be dangerous. You know the trade can still be successful as long as neither exit point has been hit.

It is important to trust your predetermined exit points if you want to stop losing and become profitable. Those who sell early often prevent their trades from reaching the profit target.

⋯

Paying attention to these rules and tips can help a struggling trader turn things around.