Setting the Record Straight

To be very clear, there are not a tremendous amount of day traders who are successful, but there are many people who survive as day traders. Many day traders start off excited, motivated and joyful and along the way that turns into shame, disappointment, loss and fear.

Do not be fooled, everyone has something to lose, whether it be family, a vehicle, mortgage etc. and in day trading, nearly all of your savings can be lost. Not only can it deprive you of physical things, but mental and emotional health is on the table as well. Day trading can take your confidence, your pride, and both your emotional and physical health. But you can survive it and even sometimes turn it around. No trader achieves success without trial and tribulation first.

This article will go through some basic tips and concepts that will help you increase your chances of generating profit while day trading, such as intraday price essentials, the value of a trading plan and a realistic one at that, as well as the importance of the underlying market conditions.

Day Trading Without a Plan is Lethal

Trading is inherently very emotional and the market manipulates these emotions. There are traders who hear news or see an opportunity throughout the day and based on that intel decide to enter or exit a position. Your day trading exit and entry rules MUST be planned way ahead of time!

Not only do you need the basic entry and exit plan, but a solid contingency plan is required as well in case something unexpected occurs during the trading session. The news or other fundamental announcement can have major implications on your position, and traders must be prepared for every foreseeable situation that may occur. Nonetheless, if the markets are range bound and choppy without any news on the horizon, do not be paranoid. A paranoid trader is almost as lethal as a trader under no plan.

That being said…

Know Your Intraday Price Levels

Many beginning traders make this fundamental mistake of not knowing price levels. Each day the market trades at important intraday support and resistance levels. These levels dictate the previous few days short term support and resistance areas as well as price points that are vulnerable to breakouts and pullbacks.

What are Support and Resistance Levels?

In very basic terms, support represents a low level a stock price reaches over time, while resistance represents a high level a stock price reaches over time. Support materializes when a stock price drops to a level that prompts traders to buy. As a result of the demand, the stock price begins to rise. Conversely, resistance materializes when a stock price rises to a level that prompts traders to sell. This selling causes a stock price to stop rising and start dropping. Once an area or zone of support or resistance has been named, those price levels can serve as potential entry or exit points. This is because as a price reaches a point of support or resistance, it will either bounce back away from the support or resistance level, or violate the price level and continue in its direction until it hits the next support or resistance level.

What are Breakouts and Pullbacks?

Breakouts and pullbacks represent two entry types. Breakouts are versatile and can be used in any trend personality. However they are more applicable to a fast-moving trend with small, shallow pullbacks or breathers. Just keeping it simple and sticking to the basics, breakouts are when a price closes beyond a previous pivot level. Breakouts, therefore, confirm a trend continuation and allow the trader to buy high in an uptrend.

Pullback entries on the other hand, are when a price pulls back or retraces to a support level in an uptrend, or a resistance level in a downtrend. Many traders look for a bounce to add confidence that the pullback has exhausted and price is likely to continue in the direction of the trend before they make a decision. Compared to breakouts, pullbacks are not as versatile and are therefore not suitable for these fast moving trends.

Have a Realistic Trading Strategy

Oftentimes swing traders seeking day trading success find strategies that look good on paper but are impractical or highly difficult to execute under real market conditions. Some argue that roughly 70% of all strategies that look good on paper won’t work out simply because execution is unrealistic, there’s too much slippage. Slippage describes the difference between the expected price of a trade, or expected fill price, and the actual price at which the trade is executed. To ensure your strategy is realistic, start with as little as 10 shares and test the strategy to see how it performs on paper versus actual performance.

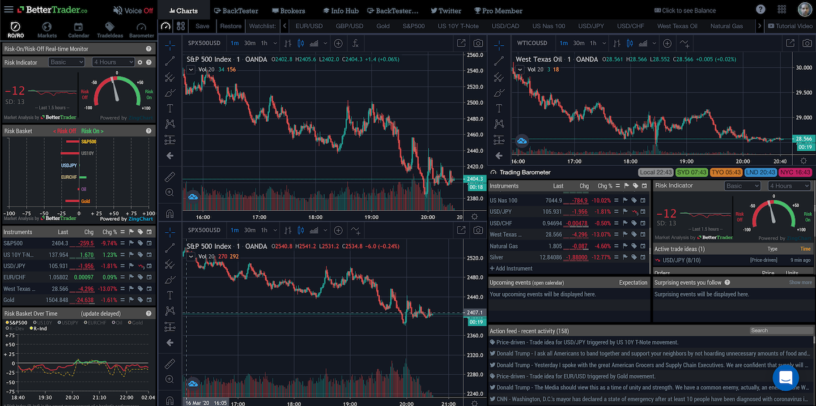

Know The Underlying Market Conditions

The final mistake many traders make when seeking day trading success is ignoring or going against the current economic conditions. The market and your day trading setup must work together to see profitable results. It’s crucial to keep an eye on the daily economic conditions and the daily charts of the stocks and indexes you are trading so that you know what is going on in the market. Without looking at the underlying market conditions and moving with the market, as a day trader you will be swimming against the tide.

Conclusion

Day trading success is possible with hard work, dedication and following basic trading principles. Trading with a plan, understanding the intraday price levels, having realistic trading strategies and being wary of the underlying market conditions, your odds of success can be that much greater.