As a trader, you have probably seen just how fast commissions can “eat up” your profit. While it is possible that this is accredited to your broker having extra fees and unrealistically high commission prices, it is more likely that you are simply overtrading and racking up small commission prices that become much greater when multiplied by many market entries and exits. It is important to recognize that you’re probably not paying too much because of your broker, but you are paying too much because of your mall activity. You are essentially trading inefficiently which in turn has become costly as well.

How to not pay high commissions:

Every time you enter the market to trade, there is a commission you have to pay. As a result, if you’re constantly going in and out of trades then your commissions increase and as a result, the commission percentage from your profit becomes much more significant. Clearly, you are trading in a very costly manner. Simply by trading less, you will be a better trader.

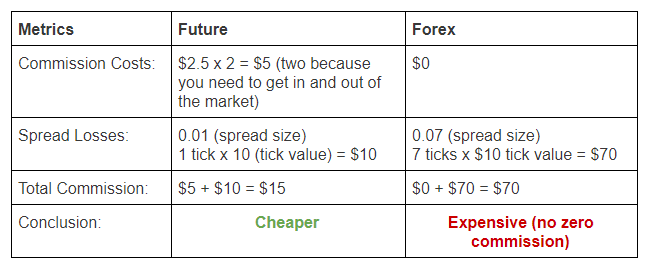

Even if your broker claims “zero commission”, there is a commission, it is just hidden in the spread. For the same transaction let’s analyze how the commission ends up with a futures commission and a forex zero commission. For this example, we are creating a situation where one enters the market in the opening position and then immediately exits.

→ Traded Asset: West Texas OIL

→ Trade Size: 1000 barrels

→ Tick (0.01) Value = $10

→ Current price in the futures market: Bid 60.05 – Ask 60.06 (same for all futures brokers)

→ Current price in the forex market: Bid 60.02 – Ask 60.09 (different from broker to broker)

→ Futures 1 lot commission $2.50

→ Forex broker claimed commission: 0

What ends up happening:

Although trading futures is considerably cheaper than trading forex, it is important to note that the commission does add up and can result in a significant portion of expenses and reduce your profit significant if you are not trading efficiently.

The Significance of Patience:

Today’s culture is addicted to productivity, so much so that patience is portrayed as the enemy. But sometimes sitting back and doing nothing is, ironically, exactly what you need to do in order to ultimately be more productive.

It makes perfect sense that to perform at our peak, our minds must be in peak mental condition. You would never think to run a marathon without training for it in the same way you wouldn’t spend every moment of work watching television and then be able to give a presentation. Our minds have to be trained with the skills we need to perform, in order to do well.

In trading, mastering the skills of being patient and playing the waiting game of watching the markets and observing the directions before making rash decisions to enter or exit are key. Being disciplined is essential to trading within the markets. Don’t just enter, make some profit, be afraid of the risk, exit and then realize there was more profit to be made and enter again. Each time you do this you will receive a charge as a broker fee. Instead, get in and wait it out. Be aggressive with your risk and reward but wait and let the market work. As it’s clear that it is not about doing more trading, rather it’s about doing more accurate trading. Additionally, doing something that is super repetitive and doesn’t need full brain engagements is actually when you are able to do your best problem-solving. You think back and reflect on things that happened in order to make sense of them, and then you extract lessons from them. Simply by sitting and watching the markets patiently you are growing and improving your market understanding.

It’s clear that it is not about doing more trading, rather it’s about doing more accurate trading.

Conclusion:

More often than not the reasons for high payment are not due to your broker, but rather are due to an ineffective means of trading and specifically, overtrading. Overtrading is extremely detrimental and it is crucial that you are able to identify it and prevent yourself from doing it as quickly as possible. If you want more information on identifying over-trading click here. By preventing yourself from entering and exiting the market constantly, you are guaranteed for lower commission rates and successful trading.