After deciding to start trading currencies in the foreign exchange market, many traders don’t know how to find a good forex broker. Unfortunately, there are many brokers out there who do not have their customers’ best interests at heart. Even those with good intentions may not be the right match for you – there are many differences between each one, and a broker who is perfect for one trader may prove to be very frustrating for you to work with. Here is a guide to help you choose a reliable broker who will best fit your personal trading needs.

The first thing you should do is check whether the broker is regulated. In the US, they should be a member of the National Futures Association (NFA) and should be registered with the U.S. Commodities Futures Trading Commission (CFTC). These organizations protect traders from fraud and manipulative practices. Beyond this, you should do a bit of research to make sure the clients are happy with the service. For a good broker, you should be able to find many positive reviews, and very few, if any negative reviews.

COMMISSIONS – DON’T BE A FOOL

Next, you should check the commissions that different brokers charge. Many brokers advertise that they don’t charge commission at all. While this looks appealing at first glance, don’t be fooled into thinking they are running a charity service; these brokers compensate by trading at wider spreads*. You should take this into account, and do your best to analyze which brokers are actually allowing you to trade in the most cost-effective way.

Spread: The bid-ask spread is essentially the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept to sell it.

‘DEALING DESK BROKER’ OR A ‘NO DEALING DESK BROKER’

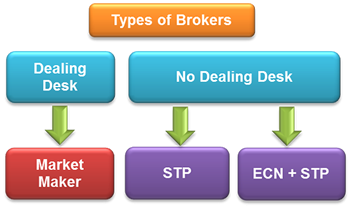

Then, you will have to decide whether you would like to use a ‘dealing desk broker’ or a ‘no dealing desk broker’. Dealing desk brokers are ‘market makers’, meaning that they personally determine the spread that they offer; the client only sees the prices they set and not the true prices in the market. They usually don’t charge commission and make their profit based on the spreads they set. This may sound scary, but the spreads are usually very close to those in the market due to the fierce competition among brokers. However, the system does open the door for malicious brokers to take advantage of their clients.

A no dealing desk broker provides a service that essentially cuts out the middle-man and connects the trader with the open market. They use an automated system that scans several sources to find a trading partner with the best price for the customer. There are two types of no dealing desk brokers: straight through processors (STP) and electronic communication networks (ECN). STP brokers usually make their money by attaching a small, fixed amount to the market price. However, unlike the market makers, they do not actively manipulate the spreads, it is more like a commission that is automatically built into the price. Meanwhile, ECN brokers offer the exact price found on the market and make their money by charging a fixed commission on each trade. Due to the impropriety of some dealing desk brokers, the no dealing desk model, and ECN brokers in particular, have become much more common in recent years, although there are certainly still many dealing desk brokers who provide an honest and fair service.

Once you have found a few brokers who fit your criteria, it is time to compare them by checking each one’s specific features. Some things to consider are minimum deposits, available currency pairs, leverage limits, withdrawal policies, customer service, and trading platforms. Most reputable brokers have an option to trade using a demo account, and it is always a good idea to take advantage of this to make sure you are comfortable with the trading interface.

Hopefully, following this advice will lead you to a great broker and successful trading!

Leave a Reply