Creating good trade signals

The way to trade profitably is to correctly predict a market reaction to a certain event or situation, and then trade confidently based on that prediction. Markets react to news, tweets, and other markets movements, creating the best opportunities for us. However, if we can’t predict a market reaction to a specific event or situation, our trades are no better than guesswork.

Accurately predicting how markets will react is where statistics and data come in. Being able to judge a situation based on similar previous situations is the best way to predict market reactions. However, accurately remembering similar situations, including what happened after those situations, can be difficult for a trader. That’s where software comes in.

When the news is released, BetterTrader’s algorithms calculate its magnitude of surprise, compared to the expected value. This is computer using statistical models, developed with historical market data. Then, it interprets this release, classifying it with terms such as a bit stronger or much weaker. Understanding if the release was stronger or weaker helps us predicts which direction markets will move, and the magnitude of surprise of the release helps us to predict how much they will move.

But what can we do with this information? How do we then know which markets should be traded? Is the news triggering a leader or follower market? Knowing the magnitude of surprise alone isn’t always enough to predict market reactions with enough confidence to trade.

Once again, software can help. BetterTrader’s artificial intelligence (AI) can do this for you, by collecting, analyzing, and then interpreting all the relevant data needed, producing a Trade Idea.

Let’s demonstrate with an example:

Say the release of US unemployment data is classified as much weaker than expected. This is good to know, but how exactly should we react to it? Is the best opportunity GOLD, EURUSD or in the S&P500?

BetterTrader is able to calculate that, in 10 similar situations to this, following a release of much weaker than expected US unemployment data, the S&P500 went up 8 times.

This is a nicely presented statistic, and we now know that this is statistically backed trade. But as an experienced trader, there’s more we want to know. How do we manage the trade? When should we enter, when should we take a profit, and when should we quit if it all goes wrong?

The Trade Idea also features this information. It computes that, when the market went up (8 times), it went up to at least X amount, given as the profit target. It also calculates the low price at which you should sell, given as the stop loss.

Trade Ideas give you all the information you need to confidently make good trades, but what if you want to come up with trade ideas for yourself? We understand that professionals might find it difficult to trust the conclusions of others without seeing evidence. More importantly, they often have their own insights market insights, gained through years of experience.

The BackTester benefits

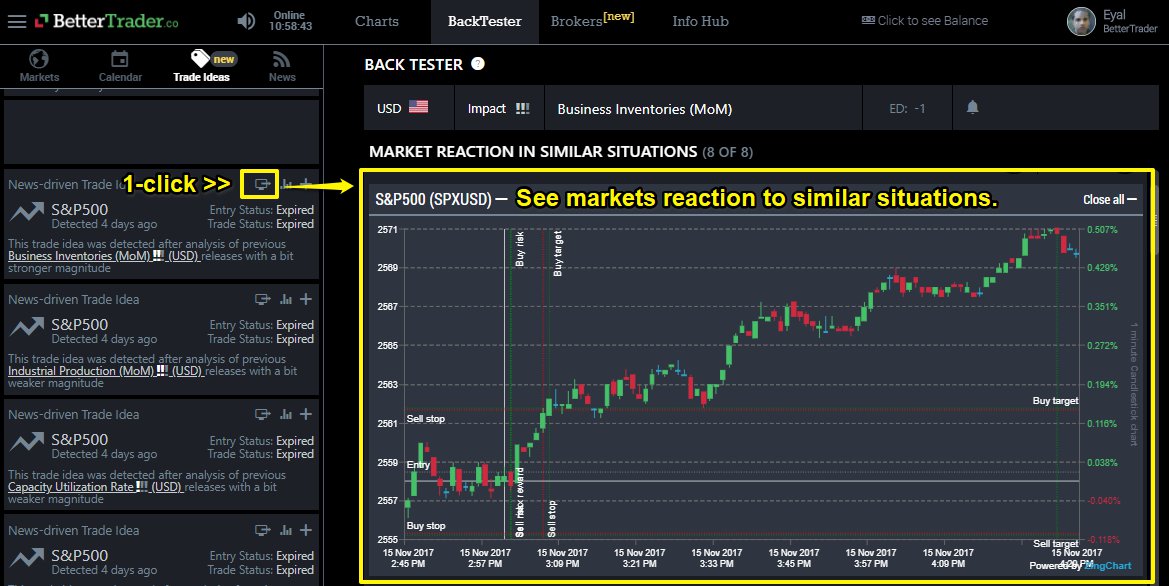

BetterTrader’s BackTester gives you access to all the data we use to calculate our Trade Ideas, and lets you and access and format it easily. You can investigate how our Trade Ideas are generated, or make your own. You get the opportunity view historical charts and build a broader picture of how the market reacts.

Trade Ideas give a small snippet of the market, which is just enough information to make good trades. The BackTester shows the big picture, which is what professionals want.

The Trade Idea says that 8 out of 10 times there was a release of much weaker than expected US unemployment data, the S&P500 went up. By using the BackTester, you can see a list of those 10 similar situations, and analyze each one, allowing you to apply your insights to each one. This analysis gives you the ability to asses the Trade Idea for yourself, allowing you to be as confident as possible before you put any money on the line.

S&P500 reaction to a release of much weaker than expected US unemployment data

Professional traders need to see the big picture in order to truly understand markets and improve their market intuitions. The BackTester makes that possible with just a few clicks.

There are lots of ways to learn to use the BackTester. Use the tutorial in BackTester tab on the web app, check out other blog posts, or join one of our upcoming webinars.