The short and sweet answer to this question is yes because otherwise, no one would do it. However, though it is possible to make a living trading Forex it is very difficult. The reality is that 96% of Forex traders end up losing money and eventually quitting. This is a terrifying statistic and highlights that to be a successful Forex trader you need a combination of both, practice and skill.

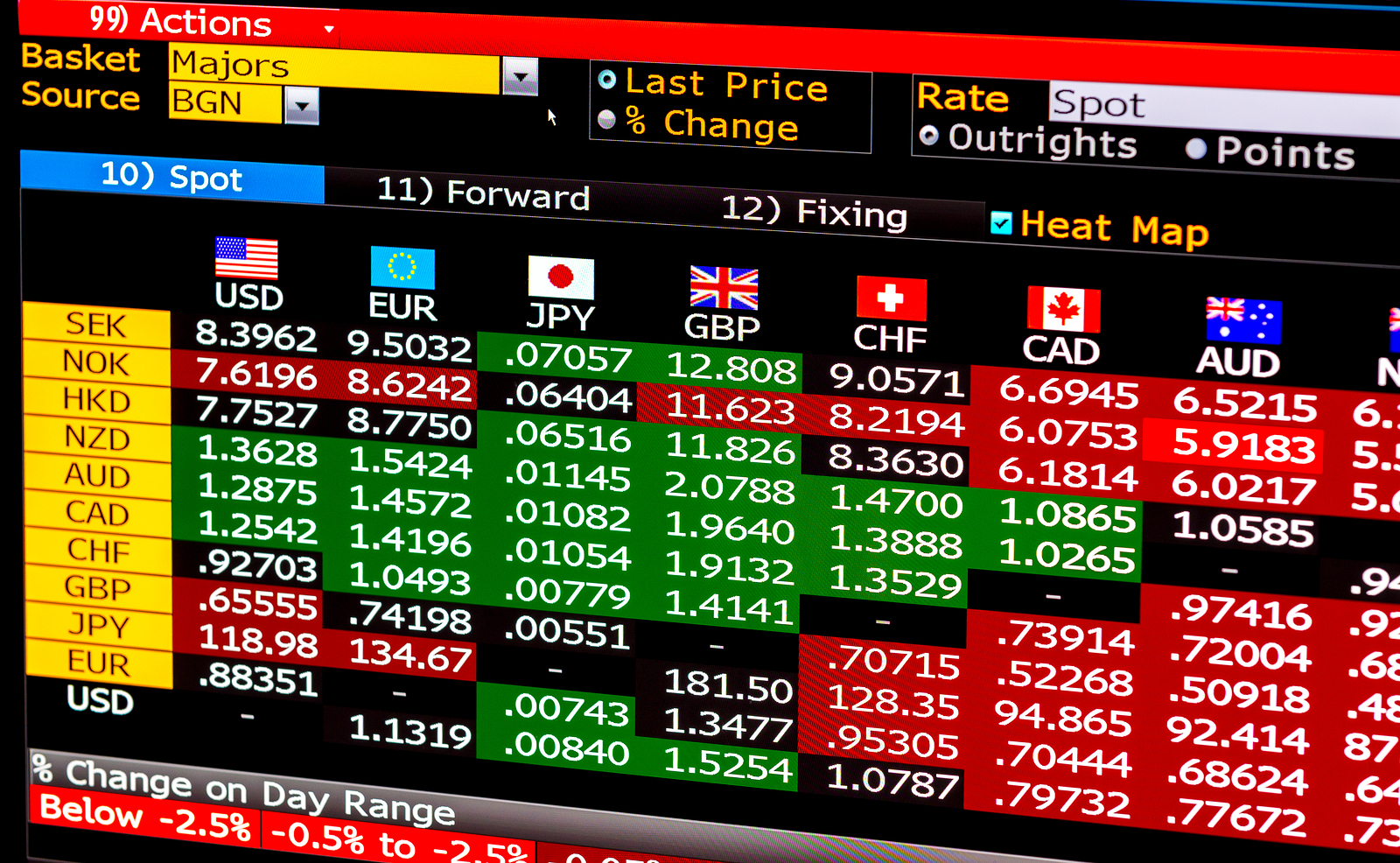

To start off I think it is essential to understand exactly what Forex trading is. Forex trading is the process of trading currencies over the Foreign Exchange Market. The process of trading currencies is essential for all foreign trade to occur. For example, if you are living in the U.S. and decide to purchase Italian Mozzarella, either you or the company that purchased the cheese must pay the Italian distributor in Euro’s. This means that the U.S. importer would have to exchange the equivalent U.S. dollar to Euro’s and this exchange is how and why Forex exists.

Making a living through Forex trading is certainly hard, but there are a variety of factors that can make it significantly easier for this to even be a possibility. One of the first factors is your level of starting capital. The exact amount of disposable income that you will need to make a living varies from person to person. It is, however, essential that all traders have a decent amount of disposable income to ensure that you can earn enough money to support yourself while at the same time not risking too much of your income on one trade.

Practice makes perfect and trading Forex is no exception. The second and possibly most important factor is practice, this includes having a solid trading method. This includes having a good idea of possible market moves such as which stocks are correlated to each other. Many of these strategies are developed through a trial-and-error process, which takes both time and practice. You will ultimately never be able to perfectly predict how the market will move or to what extent it will move but having a general understanding of the market will help limit the errors you make. Once you have developed a strong trading plan it is also essential that you adhere to it.

It Is also always essential to be malleable! The way that the market works is always changing, and it is just as essential that you develop and change with it. One of the biggest mistakes that professionals make is that they stop being students of the market. This is a huge mistake because even if you have been trading for years it is essential that you continue to develop your knowledge as there are always new stocks and news events entering the trading world.

Even if you do all of these steps the reality is that 96% of people do not make a profit let alone make a living. This is a very disheartening statistic and you have to be willing to put in the time and take some financial hits if you ever plan on being successful.

Practice makes perfect – BUT

Practice makes perfect, but it would be silly to not use the statistical programs that are now at our fingertips. The ability of AI to analyze historical information and predict the course of action is valuable advice to any forex trader. There are many platforms in the market that now provide this information and below are a few of the platforms that I recommend.

For professional traders, some of the most expensive, but powerful platforms are:

- Bloomberg Terminal, 2000$/month

- Reuters, $1200/month

If you are looking for a professional, economical platform I would recommend:

- Tradingview, $0 – $100/month

- Bettertrader.co, $0 – $100/month

All of these provide a great way of keeping up with live events and to get advice on your decisions. It’s a very useful tool to make you not a part of the 90% of forex traders who are losing money.