Day-trading

Day-trading can be summarized as buying and selling stocks over the course of trading hours with the goal of achieving quick profits from stock price fluctuations. Day-trading is characterized as having more risk as opposed to buying and holding undervalued stocks for the long term. Because of this risk, it is important to stick to a set of rules in an effort to minimize losses and maximize profits.

Develop a Strategy

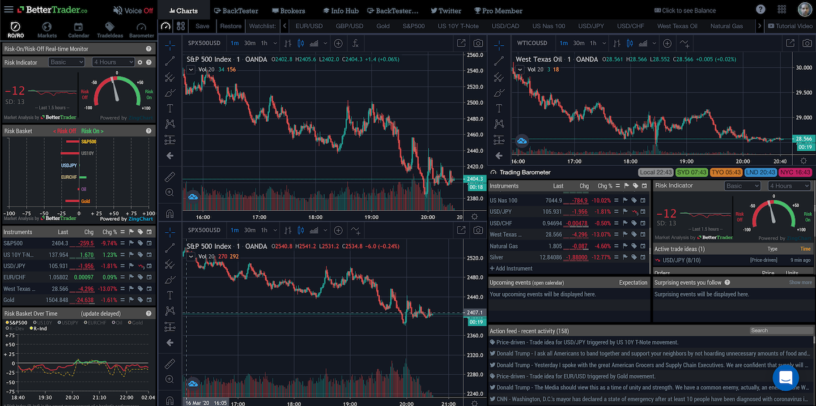

Due to the volatility and variation of the market each day it is important to have a strategy for trading. It is important to create a strategy or base for trading, whether through certain market triggers or stock fluctuations. Sticking to one plan of action is important to decrease the volatility of your account. Part of making a plan can be experimenting with a variety of factors that cause stock prices to increase or decrease, then eventually fine tuning the factors that have historically influenced the stock prices in a similar manner, and implementing them into your strategy.

A strategy is greater when previous historical analytics are taken into account and algorithms can be implemented to be prepared to make a trade based off of an event.

Follow the trends of the day

Intraday markets go through periods of going up or going down in accordance to the general market performance. It is rare, and much more risky, to trade against the trend of the market for the day. When the market is increasing, choose stocks that are expected to and have the potential to increase. When the market is decreasing, choose stocks that may go down (short-sell). When markets are moving up it is important to capture this movement early and trade with the stocks that will move aggressively to capture profits. This is the same with decreasing markets. An intraday trader must follow the trend of the market for the day and capture the moves, not fight against.

An intraday trader must follow the trend of the market for the day and capture the moves, not fight against.

Large macro events that influence the stock market provide a great opportunity to capture the trend and implement a strategy to maximize profits.

Establish Market Positions with Limit Orders

A limit order allows a trader to control the purchase price and selling price with a stock purchase and sale. This allows one to manage unwanted losses. This is especially useful when there is a large bid-ask spread, where buying at a specific price maximizes profits when large amounts of shares are transacted. Limit Orders, as opposed to Market Orders, allows the intraday trader to know the exact stock price amount when purchased and sold, which is important for when transactions are done with incremental gains or losses.

Execute Discipline

A core concept of intraday trading is finding a method to gain profits in the midst of volatility, which requires an intraday trader to be disciplined enough to cut losses early and treat transactions as strictly for business. It is important to not get overwhelmed by the activity and be grounded with a base strategy to get in then out.