How does it work?

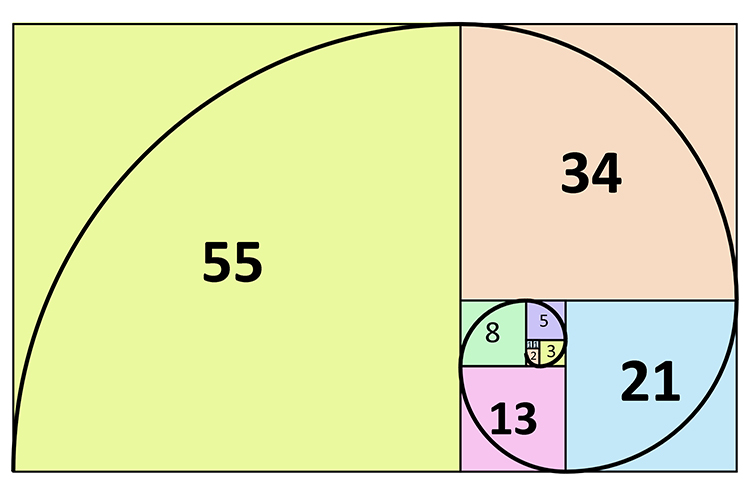

The famous Fibonacci sequence is a sequence of numbers such that each number sequence is calculated by adding the two previous numbers, starting with 0 and 1. The Fibonacci sequence goes:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144,…

The Fibonacci Sequence provides Fibonacci retracement, a widely know tool in the Forex and equities markets. Fibonacci retracement is a process which uses ratios found in the Fibonacci Sequence to predict market behavior.

The most important ratio found through Fibonacci retracement is 0.618 (sometimes known as the golden ratio). It is calculated by dividing a number by the number immediately following it, excluding the first six numbers. Another ratio is 0.382, which is found by dividing a number by the second following number. For instance, 34/89=.382.

Why are these ratios important?

Often, retracements (or reversals) happen in markets. A stock or currency will go against its general trend, before once again following it. For instance, a stock might have a general upward trend, but it briefly dips downward several times on the way up. Each dip is a retracement, also known as a reversal. The ratios calculated from the Fibonacci sequence try to predict the magnitude of those retracements as they happen.

Traders take two extreme points, the peak and the trough, and find the vertical distance between the two. They divide the distance by ratios calculated using the Fibonacci sequence, such as 0.618 or 0.382. Many traders use 0.500 as an additional ratio. Horizontal lines are drawn at each of these prices on the graph. Most stock or trading platforms today have a feature which will draw these horizontal lines automatically.

These horizontal lines are used to identify support and resistance levels for the given stock or currency. Support and resistance levels ideally help indicate the point where the retracement will end. This is where the stock or currency will resume its general trend. Alternatively, they can be used to help identify stop-loss orders and target prices.

Is it reliable?

That depends on who you ask. Fibonacci retracement is claimed to be highly reliable by the people who profit from it, and terrible by those who lose money. The ratios calculated from the Fibonacci sequence are a very subjective tool, because different interpretations lead to different results.

There is no mathematical proof behind the rationale of the Fibonacci ratios on the market. They only provide possible correlations, and do not provide any signals for the trader. The Fibonacci ratios should be looked at as a potentially useful tool, depending on whether one is successful at interpreting the results.