What is backtesting, anyway?

Backtesting is defined as: the process of applying a trading strategy or analytical method to historical data to see how accurately the strategy or method would have predicted actual results. It is used to assess the viability of a particular trading strategy or method, in order to see its potential success or failure. Backtesting relies on the assumption that past performance and situations will correlate to future performance and situations, although this can never be guaranteed.

Trading strategies used to be relatively simple, allowing them to be assessed empirically. However, newer strategies, especially those generated by machines, are significantly more complicated. This makes backtesting one of the only effective ways to assess the feasibility of a new strategy.

Backtesting can be extremely beneficial to optimize a trading strategy, by giving an idea of its potential risks, results, and profits, before putting risking any capital. If done successfully, the backtester can give an indication as to whether or not a strategy will yield profits, giving traders who backtest a powerful way to assess their trading strategies.

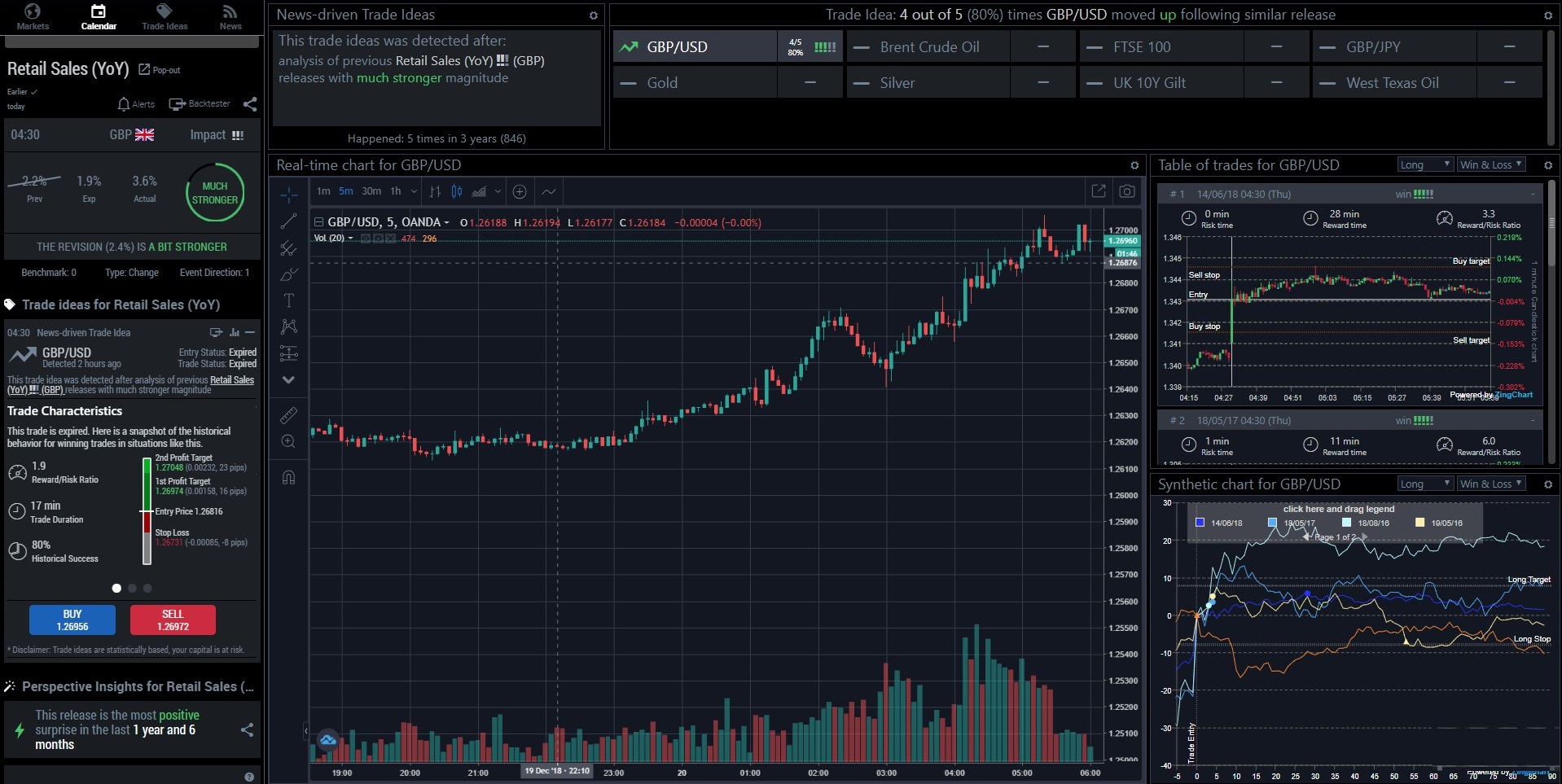

Traders today have sophisticated software to help them in the backtesting process. The BackTester tab on the BetterTrader web app gives traders 1-click backtesting for economic events and news releases.

Nuances of backtesting

The beauty of backtesting is that it can provide a variety of feedback and predictions, including return percentages, volatility of stocks, and revenue. However, it is important to note that backtesting is not a guarantee of future success, because it relies on the assumption that past performance will correlate to future performance.

Backtesting, although generally reliable, can have a few pitfalls. First and foremost, there is a tendency for people to include their own biases and preconceptions when developing the backtest. Secondly, small details may be left out of a backtest. Negligible factors can accumulate over time, resulting in a significant impact. For these reasons, a good backtest should use data that is as unbiased as possible, and should include as much detail as possible. This can be difficult when dealing with historical data, so sometimes other tests should be carried out in conjunction with a backtest. Good supplementary tests include out-of-sample testing and forward performance testing.

Why does backtesting benefit forex trading?

Forex trading (shorthand for ‘foreign exchange’ trading) revolves around the buying and selling of currencies in foreign markets. Forex traders try to maximize profits by predicting which currencies will appreciate or depreciate, relative to others. Therefore, backtesting is one of the most popular approaches to developing trading strategy in the forex community.

Many of the most important and most frequently considered parameters when constructing a forex trading strategy are addressed by backtesting. These include:

- Total profit or loss

- Average profit or loss

- Success ratio, the number of winning trades to the number of losing trades

- Maximum drawdown as a measurement of risk

- Risk-adjusted return (often calculated with the Sharpe ratio)

Interested in backtesting? BetterTrader has features to help. If you’re just getting started backtesting, check out some of our other blog posts, or join one of our upcoming webinars. If you’re a pro ready to get started, head to the BackTester tab on our web app.