Understanding the stages that a market goes through, is crucial when trading the financial markets. This cycle is unique and each stage has its own driving factor. The four phases of this cycle are Accumulation, Markup, Distribution, and Markdown.

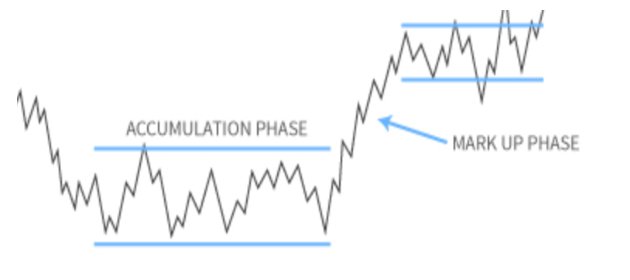

#1 – Accumulation Phase

With the first stage, there is a process of accumulation. The Accumulation stage is driven by large institutional demand. The result of this phase is the buyers slowly gaining traction in the market, eventually pushing the market price up. This phase is where the bulls build up their authority. Price action is relatively flat, creating a ranging market structure within the zone of support and resistance. Within the structure, higher lows give the price action signal that the market is in this stage.

#2 – Markup Phase

The second phase within this trading cycle is the markup. This is where the buyers take over to gain the traction they intended on gaining in the first phase. Price is pushed through the upper resistance level of the ranging market. Candles start to close with strong bullish bodies, sending a signal that price is entering the second stage. In this stage, there is an emerging bullish trend in price.

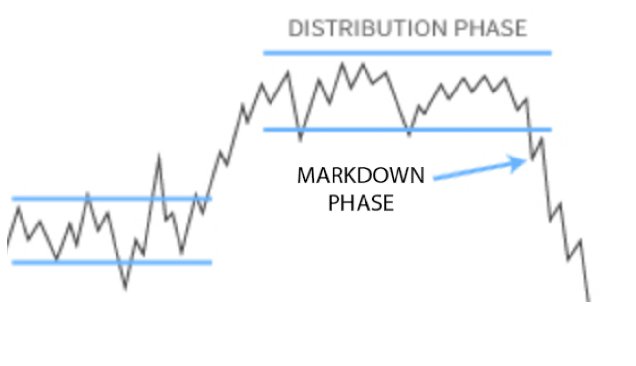

#3 – Distribution Phase

This next phase involves a distribution process where the sellers are attempting to take back their position in the market. Similar to the accumulation phase, price action on the chart is flat. Price is building up for a drop to become cheaper. This is signaled with a failed break of the upper level of the market structure. Price consolidates and creates lower highs indicating that there will be a selloff taking effect.

#4 – Markdown Phase

The last and final stage of the market cycle is labeled as the markdown phase. This process occurs after the distribution of the higher price. The selloff drags price and the market begins a downtrend. This process provides an indication that the bears have taken over the market and have gained enough power to take price within the market to a cheaper level in the bearish direction. There is confirmation of this when price action shows a break of the lower level of the flat ranging market. Technicals show large candles sticking out of a descending horizontal distribution channel on the chart. After this entire market cycle takes place, the whole thing starts all over again with the Accumulation process.