Price-Driven Trade-Ideas – What they are and how you can benefit from them.

The markets are constantly moving and changing.

There are many factors that impact any specific market instrument at any given time.

One area that includes good opportunities for traders to engage is the concept of Leading and Following Markets.

The fundamental trading concept that this technology is based on is called Leading and Following markets. This fundamental concept is used by professional traders who trade the Following Market after they see specific moves in the Leading market.

You don’t want to predict (gamble) what the direction of any specific market will be, that’s why it is much better to identify one market that follows a different one and then trade it when you see the Leading market has already moved.

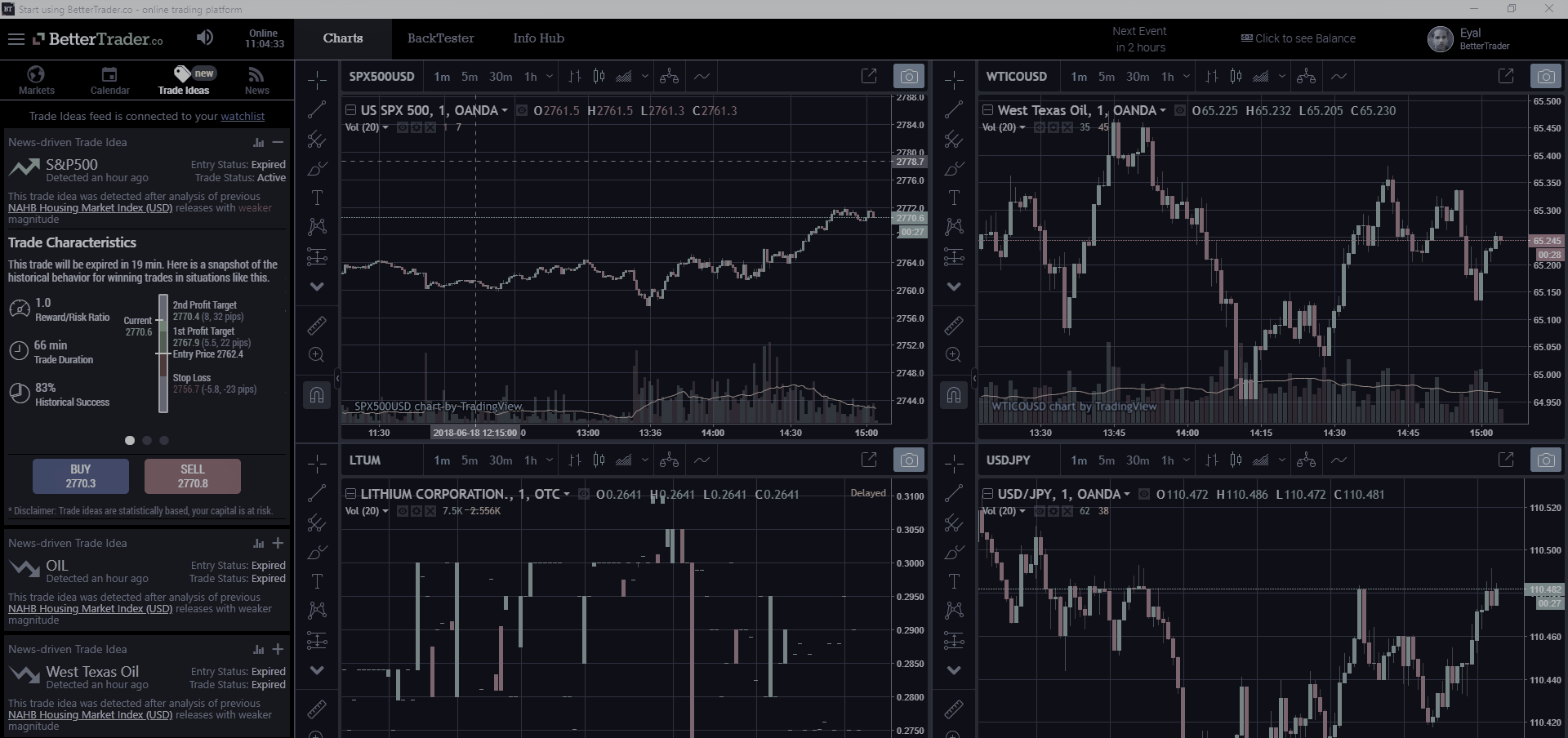

Let us explain this concept by example; Recently when oil moved down significantly, you could see the S&P 500 move upwards, so once oil moved down it could be a great opportunity to buy the S&P 500. There is a much better probability of success in now buying the S&P 500, as opposed to guessing oil’s next move.

Sometimes the opposing case will be true; A big gain in the S&P 500 will be followed a big gain in oil, then we will say that the S&P 500 is Leading oil and oil is Lagging the S&P 500. Other times we may not see any correlation between the two.

Statistical Significance

We rely on Statistical Back-Testing to identify the most recent connections and correlations between instrument’s, to ensure we produce High-Level data with Statistical Significance. We are constantly tracking all of the markets to detect market instruments that are leaders and followers.

Once the correlational pattern stops to work for some time, the statistics significance breaks and then you have no Leader or Follower until new statistically significant data accumulates. So if we know that the last fifteen times the S&P moved up 3 points, oil moved up $0.5, when the S&P 500 moves up 3 points we need to know about it and to take a good long look at the oil.

Trading Edge

One way to establish a trading edge is to know which market instrument is a leader and which instrument is a follower. This is an edge because you have a hint ahead of time regarding a specific instrument, which direction and how much it is likely to move,.

The challenge is that markets are dynamic, so Leaders and Followers are constantly changing. These changes are why it is so hard and time-consuming to constantly know which market instrument is leading and which is following. The good news is that you no longer need to, BetetrTrader.co Artificial Intelligence does that for you. Price-Driven Trade Ideas is based on AI that is constantly tracking all the markets and letting you know of any significant Trade-Ideas.

This feature available on the BetterTrader.co app, for more information, click here